What is W-9 Form? How Do You Fill It Correctly in 2025?

Form W-9, a vital document in the realm of taxes, might appear overwhelming initially. But fear not! In this comprehensive guide, we will unravel the complexities surrounding Form W-9 and provide you with a straightforward, step-by-step walkthrough. Whether you’re a Certified Public Accountant (CPA), accountant, small and medium-sized business (SMB) owner, or bookkeeper, comprehending this form is essential for ensuring smooth financial operations. Let’s venture into the world of Form W-9.

What Is a W9 Tax Form

The W-9 tax form, officially called “Request for Taxpayer Identification Number and Certification,” is a document used by businesses in the United States to collect your tax identification information for accurate tax reporting.

What Is W9 Tax Form Used for

Businesses often use Form W-9 to request necessary information from vendors, freelancers, or contractors. This information is vital for reporting payments made during the tax year. Form W-9 ensures that businesses report their expenses accurately to the IRS.

Who Needs to Fill Out a W-9 Form

Individuals who receive income from interest, dividends, rents, or royalties, and those working as independent contractors or freelancers, often need to fill out a W-9 Form. Banks, lending institutions, and contest organizers may also request this form for specific purposes, ensuring compliance with IRS regulations.

When and How to Request a W-9

If you’re a business owner engaging with a contractor or freelancer, it’s essential to request a completed W-9 Form before any work commences. Failing to do so can lead to complications down the line, potentially requiring you to pay withholding taxes on the payments you make. So, be proactive and ensure you have a W9 on file for all your independent contractors and freelancers.

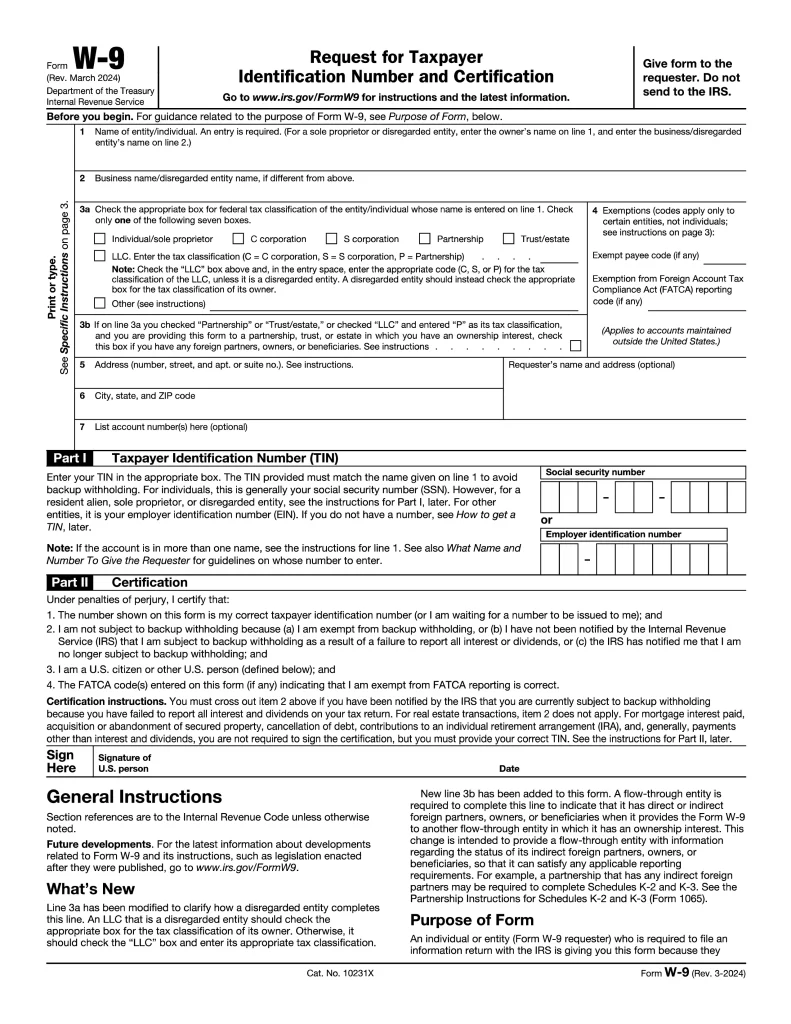

How to Fill Out W-9 Form IRS

Navigating tax forms may seem complex at first glance, but is a straightforward document when broken down step by step. We’ll walk you through the process of filling out the W-9 Form IRS, ensuring that you provide accurate information and comply with IRS regulations. This Form pdf is available on the IRS website. Visit the website and follow the below instructions.

Step 1: Line 1 – Enter Your Name

Begin by entering your name exactly as it appears on your tax return. This step ensures that your identification is consistent across all documents.

Step 2: Line 2 – Enter Your Business Name

If you operate under a business name different from your personal name (for example, as a sole proprietor or DBA), enter it here. Clarify your business identity for accurate record-keeping.

Step 3: Line 3 – Select Your Business Entity

Choose your federal tax classification: sole proprietorship, partnership, C corporation, S corporation, trust/estate, limited liability company, or “other.” Select the appropriate box that aligns with your business structure.

Step 4: Line 4 – Exemptions (If Applicable)

Most individuals will leave this section blank. Exceptions include exempt payees (e.g., certain corporations) or those exempt from reporting under FATCA. Refer to IRS instructions for specific codes if applicable to your situation.

Step 5: Lines 5-6 – Provide Your Address Details

Enter your street address, city, state, and ZIP code. Use the address associated with your tax return, ensuring seamless matching of 1099s and Form 1040.

Step 6: Line 7 – Optional: Requester’s Name and Address

If desired, provide the requester’s name and address for your records. Additionally, include relevant account numbers if instructed by the requester.

Step 7: Part I – Provide Your Tax Identification Number (TIN)

For sole proprietors, use your Social Security Number (SSN). Other business entities utilize the Employer Identification Number (EIN). If your business is new and awaiting an EIN, write “applied for” and promptly obtain your EIN to avoid backup withholding.

Step 8: Part II – Certification

Before signing, certify the following statements under penalty of perjury:

- The number provided is your correct taxpayer identification number (or you’re waiting for issuance).

- You’re not subject to backup withholding due to exemption or IRS notification.

- You’re a U.S. citizen, resident alien, or other U.S. person.

- If applicable, ensure FATCA reporting codes entered are correct.

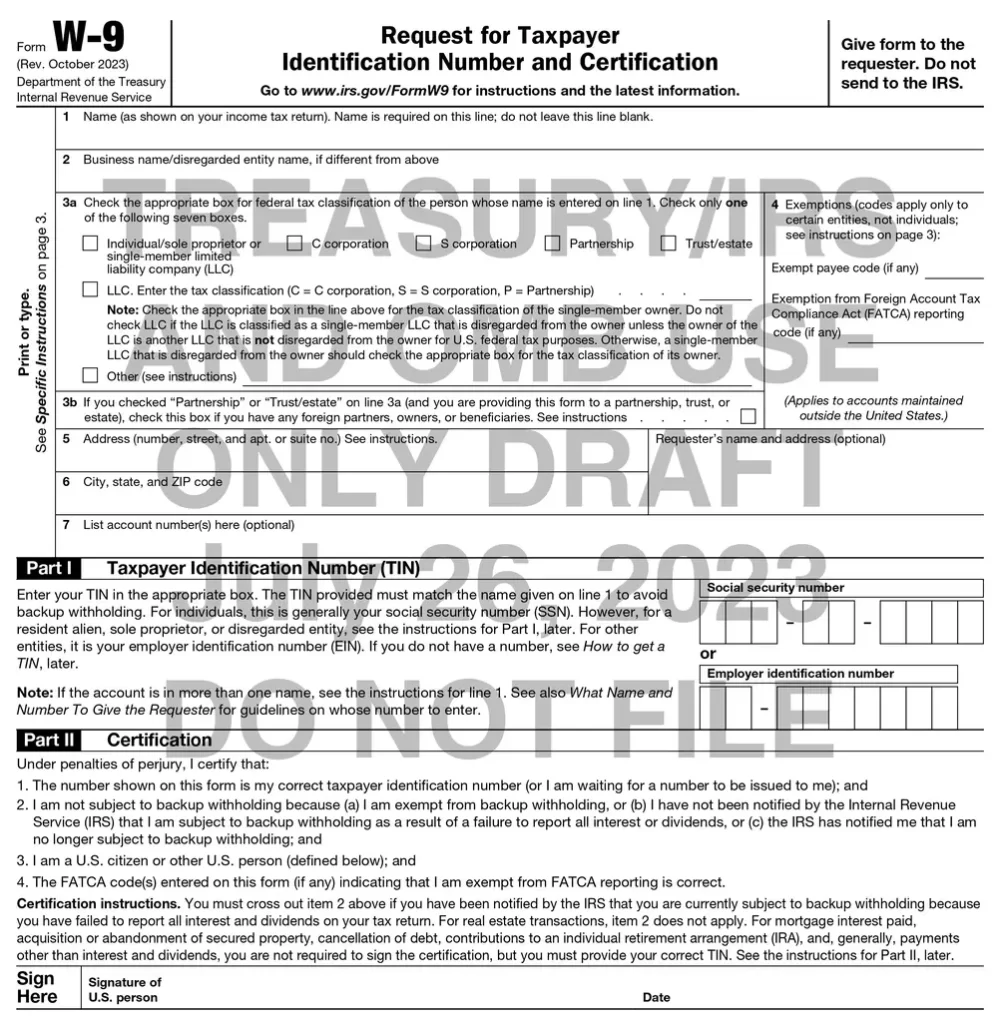

Updates in W9 Form 2023

The IRS has released a draft of the W-9 Form 2023, Request for Taxpayer Identification Number and Certification, which includes a new reporting requirement for flow-through entities.

Flow-through entities are entities that pass their income and losses through to their owners or members without paying corporate income tax. Examples of flow-through entities include partnerships, limited liability companies (LLCs), S corporations, and trusts.

The new reporting requirement requires flow-through entities to identify the presence of direct or indirect foreign partners, owners, or beneficiaries when they provide Form W-9 to another flow-through entity. This information will help the receiving flow-through entity determine whether it has any applicable reporting requirements, such as the requirement to complete Schedules K-2 and K-3 for foreign partners.

The new reporting requirement is intended to improve the IRS’s ability to track and enforce tax compliance among flow-through entities and their foreign partners, owners, and beneficiaries.

Form W-9 (Rev. March 2024)

While the core purpose of the W-9 form (Request for Taxpayer Identification Number and Certification) remains the same between the 2023 and March 2024 revisions and access the official form through the IRS website: https://www.irs.gov/pub/irs-pdf/fw9.pdf

Understanding W9 form is crucial for anyone involved in business transactions. By grasping its purpose and the process of filling it out, you ensure compliance with IRS regulations. For CPAs, accountants, SMBs, and bookkeepers, this knowledge is invaluable in maintaining accurate financial records and adhering to tax obligations.

Conclusion

Form W-9 might seem intimidating at first, but with the right knowledge, it’s a simple document that helps businesses and individuals stay on the right side of the tax law. By following the steps outlined in this guide, you can confidently fill out Form W-9 and contribute to the smooth operation of your financial activities.

Remember, if you ever have questions or uncertainties about the W-9 Form, consulting a tax professional is always a wise move. Stay informed, stay compliant, and keep your financial processes running seamlessly!