W-2 vs W-4: Key Differences, It’s Working and How to Fill Online 2025

The Major difference between IRS Form W2 vs W4 is that when an employee starts a new job, they are eligible to file the Form W-4 to decide how much tax to withhold from an employee’s paycheck. On the other hand, an employee can file the Form W-2 every end of the year that indicates how much an employer paid and how much tax is withheld during the year.

When setting up a business, some factors should be considered to nail the industry, be it service-based or product-based. Out of which, tax liabilities remain the point of focus. Studies show that systematic analysis of the total tax liabilities helps organizations make better business decisions. It is possible through various courses of action, such as payroll tax forms.

Internal Revenue Service (IRS) requires every employer and employee to fill out payroll tax forms known as W2 vs W4, respectively. Users have noticed a major difference between W2 vs W4 tax forms. These forms are positioned significantly in the business hierarchy and categorized as payroll tax forms. However, there are a few differences between them. This blog aims to inform you about payroll tax forms W2 vs W4 and their multiple uses. Let us have a concentrated look at the following sections!

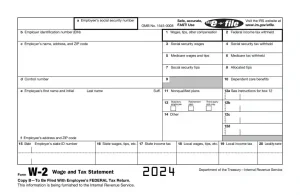

What is a W2 Form

The W2 form, officially called the Wage and Tax Statement, is a tax document issued by your employer at the end of each year. , is a year-end tax document employers are responsible for providing to the Internal Revenue Service (IRS) and each employee. It reports an employee’s annual wages and the amount of federal income tax withheld from their paycheck throughout the year. This information helps the IRS calculate how much tax you owe or how much of a refund you might receive.

- Who issues it: Employers are responsible for sending a W-2 to each employee they paid at least $600 during the year.

- What it reports: It contains important information about your income and taxes for the previous year, including:

- Total wages and taxable earnings you received

- Federal income tax withheld from your paychecks

- (Optional) State income tax withheld (if applicable)

- Social Security and Medicare taxes withheld

- Who gets a copy: You’ll receive a copy of your W-2, and your employer also sends a copy to the IRS.

What you use it for: This information is essential when you file your tax return. The W-2 helps you determine how much tax you owe or if you’re eligible for a refund.

Generally, employers make numerous copies of W-2, but they should necessarily make six copies for the following use:

- Copy A- This copy is for the Social Security Administration (SSA).

- Copy B- This copy is for those employees who have their federal tax returns

- Copy-C- This copy of the W-2 takes care of the employee’s records.

- Copy D- This copy of the W-2 takes care of the employer’s records.

- Copy 1- This copy of the W-2 is for states, cities, or local tax departments.

- Copy-2- This copy of the W-2 needs to be filled by employees. It should include their state, city, or local tax returns.

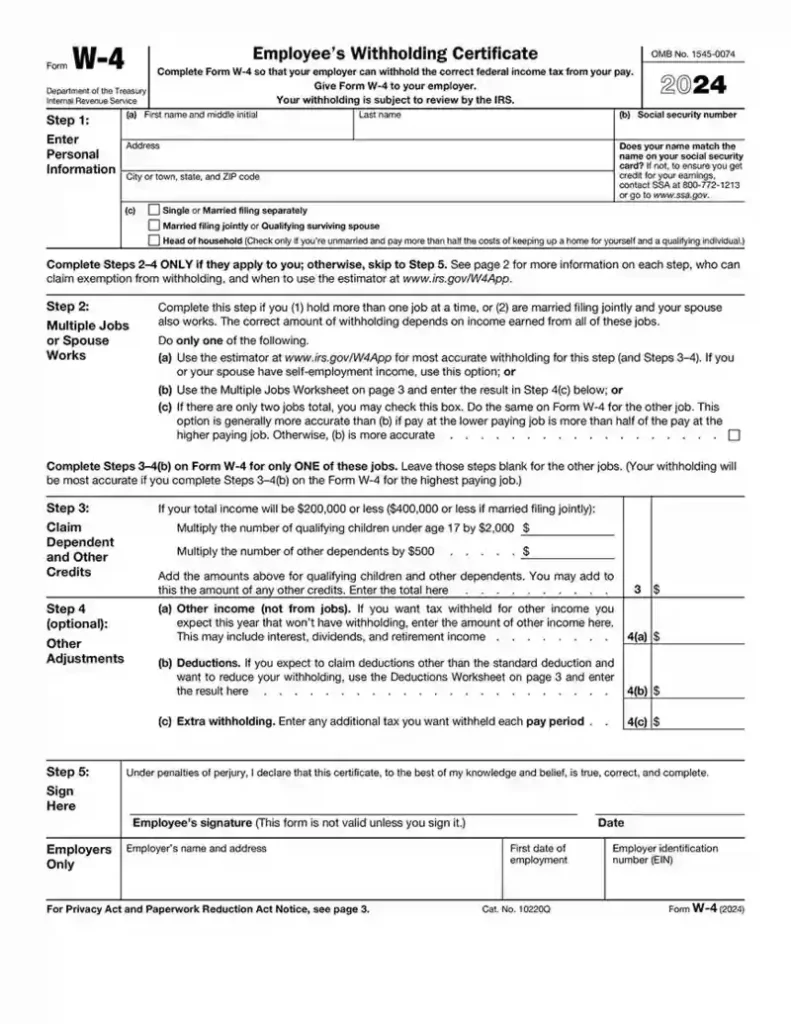

What is a W4 Form

Form W4 or Employee’s Withholding Certificate, is an Internal Revenue Service (IRS) form. Employees who work in an organization fill out the W-4 to let their employers know how much tax to withhold from their income or paycheck. Employees should fill it out correctly because incorrections lead to unnecessary taxes during the return file.

Every new employee joining a particular organization must fill out the W-4. The entire system got revised in 2020, which simplified W-4. Filling out the Withholding Form does not necessarily restrict an employee’s tax to the filled amount. The information is subject to change and employees can change it whenever they want. However, IRS subjects W4 form as a necessary document. Moreover, employees fill W-4 , whether new or old.

The structure of the W4 follows five sections in total. However, section numbers One and Five implies on employees. Moreover, filling out the remaining part helps the employer determine the exact amount to be withheld from the employee’s yearly income.

Some mandatory details include:

- Name

- Address

- Social Security Number

- Work Information

- The Status Of Filing

- Total Number Of Dependents

- Signature

W2 vs W4: What’s the Difference

The features of both forms, W2 vs W4, are not entirely homogeneous. Both are for business purposes, but the person filling them out marks a difference. Understanding the differences may be difficult because of the apparent similarities.

| Feature | W-4 | W-2 |

| Who fills it out | Employee | Employer |

| Purpose | Tells employer how much tax to withhold | Reports employee’s wages and tax withholding for the year |

| When it’s used | Upon hiring and when withholding needs to change | Filled out at year-end |

| Filed with | Not filed | IRS and Social Security Administration (SSA); copy given to employee |

How W2 Form Works?

The Internal Revenue Service requires eligible employers to send W-2 forms to their employees before Jan 31st, following the close of the tax year. Employers must submit these forms with the SSA (Social Security Administration) and the IRS by the end of January, however, may file for a 30-day extension by filing Form 8809.

Check this out: The IRS 5-Point Checklist for Return Filing

The W-2 form doesn’t involve a process for you to complete. Here’s what happens with a W-2:

- Employer Fills It Out: Your employer gathers your wage and tax withholding information throughout the year.

- Employer Sends It Out: By January 31st, your employer sends you a copy of the completed W-2 form (and electronically submits another copy to the IRS).

- You Use It for Taxes: You use the information on your W-2 to file your tax return accurately. It shows your income and how much tax was already withheld.

See the Available Sections in W2 Form in 2024

1. Represents the total wages or income, medical aid, tips, and other compensation expenses of an employee.2. Total federal tax withheld from an employee’s income.

3. Represents the Social Security Tax withheld from an employee’s income.

4. Represents the total amount withheld for Social Security Tax from an employee’s income.

5. Represents income that is subject to medical taxes

6. Represents the total amount withheld as Medical Care Taxes from an employee’s income.

7. Represents the amount of Social Security Tip given to the employers by employees.

8. represents the amount of tips distributed by the employers to the employees (this does not include in the W-2 Box 1, 3, 5, or 7).

9. As this represents a defunct-tax perk, it is left unfilled.

10. Reports the total amount of care benefits for dependents provided by the employers to their employees.

11. Reports the deferred compensation received by employees from their employer’s non-qualified plan (non-taxable).

12. Represents a wide section with various benefits and deductions from an employee’s income. It has code boxes ranging from A to HH.

13. Represents three sub-boxes that report income that is not subject to the income tax if an employee has participated in the “Employer-Sponsored Retirement Plan”.

14. Lists additional employee taxes beyond income, not included on the W-2.

15. Remaining few sections from 15 to 20 represent state and local taxes that include the total amount subject to the taxes and the amount withheld from an employee’s income.

How W-4 Form Works?

Employees fill out the W4 form and submit it to their employers. It provides information like how much tax is to be withheld from their income. As a result, it makes the entire process systematic, simplifying it for the IRS to collect federal income tax.

The W-4 process is quite simple:

- Fill Out the Form: You’ll complete a W-4 form, indicating your filing status (single, married, etc.) and claiming any dependents.

- Employer Withholds Tax: Based on your W-4 information, your employer withholds a portion of your income for federal taxes throughout the year.

- Tax Season Adjustment: When you file your tax return, you compare the total withheld tax to your actual tax liability. You may receive a refund if you overpaid or owe more if you underpaid.

- Update As Needed: You can submit a new W-4 to your employer if your life situation changes, like getting married or having a child, to adjust tax withholding accordingly.

Read this also: IRS Lists Top 10 Tax Scams To Be Aware Of This Tax Season

Conclusion

To conclude, within the first month of work, every employee contributing to the company’s payroll needs to fill out a W-4 form. Companies must give the Internal Revenue Service a W-2 form for each employee every year.

The above explanation for both W4 vs W2 forms is enough to understand to how and who needs to fill it out. If still you are facing issues let’s connect with us.

FAQs

Who is eligible for filling out the W-4 and W-2 Form?

The employers and employees fulfill the eligibility. All the people working in an organization fill W-2 and W-4 content. Likewise, organization can be product based as well as service based.

What is the completion date for the W-2 and W-4?

Employers submit completed W-2 and W-4 forms to the IRS by the end of January. The deadline is January 31st for the following tax year.

Are W2 vs W4 the same?

W-2 and W-4 are different. Both deal with payroll taxes, but the responsibility falls on different shoulders:

Employees fill out the W-4. This form tells your employer how much federal income tax to withhold from your paycheck.

Employers fill out the W-2. This form summarizes your yearly earnings and withheld taxes. They send it to you and the IRS by January 31st.

How many allowances should I claim on my W-4?

An employee can claim anywhere between 0 to 3 allowances. The more allowances, the lesser the tax. These fewer allowances result in a more withholding income, and such cases support employees asking for a refund.

When are W-2 and W-4 considered completed?

Employees complete the W-4 form within a month of starting their job. Employers send W-2 forms directly to the IRS by January 31st of the following year. The process is considered complete when the employee receives a copy of their W-2 after the employer submits the original form to the IRS.

What is Tax Liabilities on W-4?

In financial terms, your tax liability is the whole amount of tax you owe before any withholdings or payments have been made. The word “liability” comes from the same source as “responsibility”, so think of your tax liability as the amount you owe the government. You can claim exemption from income tax withholding by filling out the “Tax liabilities“ section of a W-4. Employers can use a W-4 to learn how much money an employee would like withheld from their paychecks to pay federal income taxes.

Does QuickBooks send out W2?

If you choose to automate your taxes and forms (we pay and file for you), Intuit will mail W-2s to your employees from January 20 to January 31. If you need to start on January 13, you can print them again on plain paper. You can print W-2s if you start using QuickBooks Online Payroll or any year before. QuickBooks and w-2 forms can be automated together for better tax-based visibility and clarity.

Moreover, if you use Core, Premium, Elite, Full Service, or Assisted QuickBooks Payroll versions, Intuit will automatically print and mail your employees’ W-2s.