IRS Form 941: A Detailed Guide to Filing, Instructions, and Compliance

All employers in the United States are required to adhere to certain tax obligations to fulfill federal payroll regulations. One essential document is IRS Form 941. This form is utilized to report federal income tax, Social Security tax, and Medicare tax deducted from employees’ earnings. Employers must know how to properly complete and submit this form in order to remain in compliance with federal laws and avoid fines.

What is Form 941?

Form 941, referred to as the Employer’s Quarterly Federal Tax Return, is a tax document that businesses are required to file to report the taxes withheld from employees’ wages. These taxes comprise:

- Federal income tax

- Social Security tax

- Medicare tax

Employers are required to record their contribution to Social Security and Medicare taxes on this form. Form 941, which is submitted on a quarterly basis, assists the IRS in monitoring a company’s payroll tax liabilities. It is essential to make sure that both the employer and employees fulfill their annual tax obligations.

Who Needs to File Form 941?

Form 941 is required to be filed on a quarterly basis by employers who pay wages to one or more employees. Although there are no taxes to report for the quarter, it is still necessary to submit this form if you have employees. Exceptions include:

- Seasonal employers, who can only file for the quarters in which wages are paid.

- Employers who only hire or have hired staff for household work only should file Form 1040 instead.

- Employers who employ or hire agricultural laborers are required to submit Form 943.

Do I Have to File a Form 941 if I Have No Employees?

Yes, you need to file Form 941 if your company paid wages or salaries during the quarter, even if no federal taxes were withheld. Nevertheless, if your business did not incur payroll for the quarter and has no taxes to declare, filing may not be necessary particularly if you are a seasonal employer.

What is the Difference Between Form 940 and Form 941?

Form 940 is used to record federal unemployment (FUTA) tax and is filed annually, whereas Form 941 is filed on a quarterly basis to report federal taxes. As compared to Form 941, which deals with employment taxes withdrawn from employees, FUTA taxes are paid exclusively by employers to finance unemployment benefits.

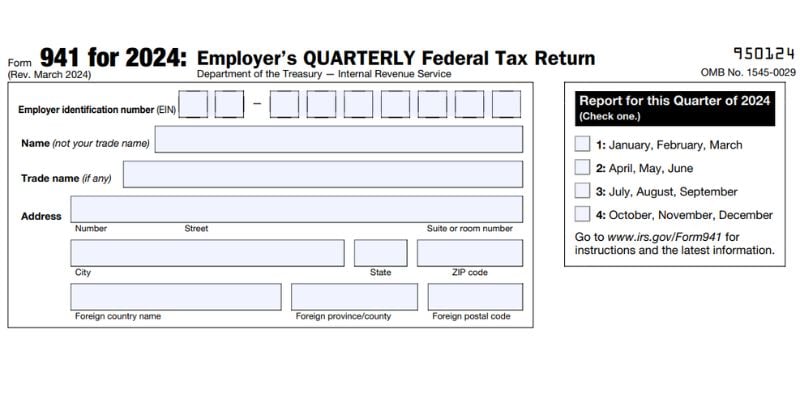

Form 941 Instructions and How to Fill It Out

Filling out Form 941 can seem daunting, but it’s straightforward if you follow the IRS instructions carefully. Here’s a breakdown of how to fill out the form correctly:

Key Sections of Form 941

Form 941 consists of several parts that collect crucial payroll tax information. Let’s walk through the form and the steps to complete it:

A. Basic Information: At the top of Form 941, you’ll need to provide basic details such as your Employer Identification Number (EIN), business name, trade name (if applicable), and address.

B. Part 1: Payroll Tax Reporting: This section captures and requires details like total wages, tips, and other compensation subject to Social Security, Medicare, and federal income tax withholding. Key fields include:

- Line 2: Total wages paid to employees.

- Line 5a & 5b: Report wages subject to Social Security and Medicare taxes separately.

- Line 6: Report the total taxes withheld from employee paychecks.

C. Part 2: Deposit Schedule and Tax Liability for the Quarter: This section needs the information of the deposit schedule. You have to specify here if you deposit money on a monthly or semi-weekly basis. This helps in determining how you compute your tax liability and when you must pay it.

D. Part 3: Calculation of Your Total Tax Liability: Your quarterly total tax liability will be determined by summing up the amounts of your federal income tax, Social Security, and Medicare, as well as any applicable adjustments.

E. Part 4: Overpayment and Balance Due: You have the option to request a refund or apply the excess to your subsequent return if you have overpaid taxes.

F. Part 5: Third-Party Designee: You may designate a third party to speak with the IRS about the return on your behalf, such as a payroll provider or tax expert.

G. Signature: Finally, the form must be signed to confirm that all information provided is accurate to the best of your knowledge.

Link to access and download Form 941 on IRS website directly https://www.irs.gov/pub/irs-pdf/f941.pdf

How to Fill Form 941: Step-by-Step Guide

- Compile Payroll Records: Prior to completing the form, gather your quarterly payroll records, including employee wages, federal income tax withholdings, and payments to Social Security and Medicare taxes.

- Give Basic Details & Information: Complete the form by providing your business’s EIN, name, and address at the top. Make sure you enter your official EIN rather than your SSN.

- Report Wages and Taxes: Finalize Part 1 by mentioning total wages disbursed and taxes withheld & deducted. Ensure precise reporting of all relevant and essential payroll information, including modifications for sick pay or tips & bonuses.

- Configure Deposit Schedule: Figure out whether you are a monthly or semi-weekly depositor. Your deposit schedule is determined by your overall tax liability and payroll size.

- Determine Total Tax Liability: Add the taxes due for federal income, Social Security, and Medicare, and ensure that any credits or adjustments are taken into account.

- Conclude and Finalize: After entering all the details, verify for completeness and sign the form prior to submission.

How Many Days After Payroll Are 941 Taxes Due?

Taxes reported on Form 941 are typically due by the last day of the month following the end of a quarter. For instance:

- Q1 (Jan–Mar): Taxes are due by April 30.

- Q2 (Apr–Jun): Taxes are due by July 31.

- Q3 (Jul–Sep): Taxes are due by October 31.

- Q4 (Oct–Dec): Taxes are due by January 31 of the following year.

If your total tax liability for the quarter is less than $2,500, you may pay when you file Form 941. Otherwise, you must deposit these taxes according to your IRS deposit schedule, which could be monthly or semi-weekly depending on the amount. Employers are required to deposit 941 taxes in conformity with the deposit schedule they have been assigned. There exist two principal schedules:

- Monthly Depositor: If your total payroll tax obligation is below $50,000 during the lookback period, you must remit taxes by the 15th of the subsequent month.

- Semi-Weekly Depositor: You have to deposit within a few days after your paycheck if your total tax liability is more than $50,000 (payrolls from Wednesday through Friday are due the following Wednesday, and payrolls from Saturday through Tuesday are due by Friday).

Make sure you follow your particular deposit schedule in order to prevent penalties.

Where to Mail Form 941?

Depending on where your firm is located and whether you are sending a payment, there are different mailing addresses for Form 941. The IRS’s official instructions for Form 941, or the IRS website, can be used to determine the correct mailing address. To avoid processing delays, make sure you’re using the latest address for 2024.

- With Payment: Send it to the designated IRS address for your location.

- Without payment: If you don’t include a payment, mail it to a separate IRS address that your state has specified.

Where to File Electronically

Organizations can use the IRS’s e-File system to electronically file Form 941, which streamlines the procedure. E-filing is an effective option for many organizations since it guarantees speedier processing and lowers the possibility of errors.

Important Links to Access

- Link for detailed instruction to fill form 941 – https://www.irs.gov/instructions/i941

- Link to know in detail about Form 941 – https://www.irs.gov/forms-pubs/about-form-941-

Conclusion

Submitting Form 941 is an important responsibility for businesses to maintain compliance with federal tax regulations. Regardless of employee status, understanding the procedure for completing and submitting this form is crucial for evading penalties and maintaining compliance with tax responsibilities. Employers can adeptly handle the process for the 2024 tax year by adhering to the processes defined in this guide and using the IRS’s official instructions.

written by

written byAbout Author