Form W-4: How to fill out it accurately in 2025

The employee’s withholding certificate or commonly referred to as Form W-4 is another important document offered by the IRS. It works to establish the amount of federal income tax that should be deducted from your salary. Completing the W-4 form properly can ensure that you do not end up paying more or less tax as required in the fiscal year. By adjusting your W-4 correctly, you can avoid both large tax bills and refunds come tax time. Whether you’re starting a new job or simply updating your withholding details, this guide will walk you through the process of filling out the 2024 W-4 form.

What Is Form W-4 Used For?

W-4 form is a document that is filled and submitted by employees to their employer’s regarding their federal tax withholding. Amount to be withheld is determined by the filing status, the income and any other adjustments that you may make on the form.

The data you provide in the W-4 form is used by your employer to determine how much tax is to be withheld from your wages. These deductions go to the IRS in consideration towards your income tax for the fiscal year. Completing this form properly saves your position neither to be surprised with a huge amount of owed taxes at the end of the year, nor to get an inappropriate amount of money back.

Key Components of the 2025 Form W-4

Before getting into the specifics of completing the form, let’s examine the main elements of the 2024 W-4 form:

- Personal Information: You need to give your name, address, Social Security number, and filing status (single, married, or head of household) in this section.

- Multiple Jobs or Spouse Works: If you’ve got more than one job or your spouse works, be sure your withholding is right for your combined income.

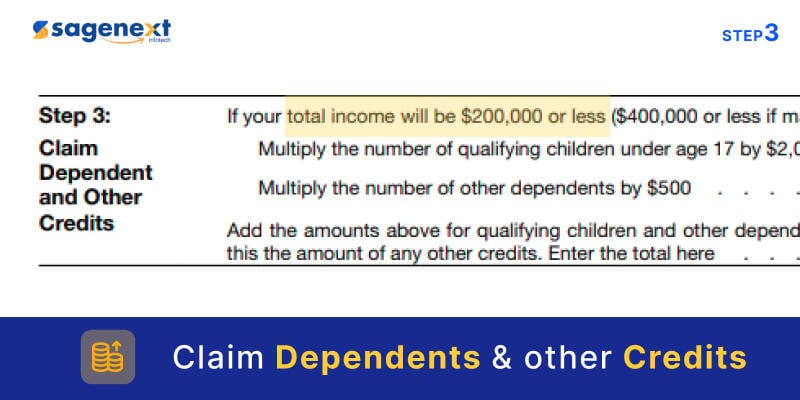

- Claim Dependents: If your total income is less than $200,000 (or $400,000 if you are married and filing jointly), you can claim credits for your dependants here.

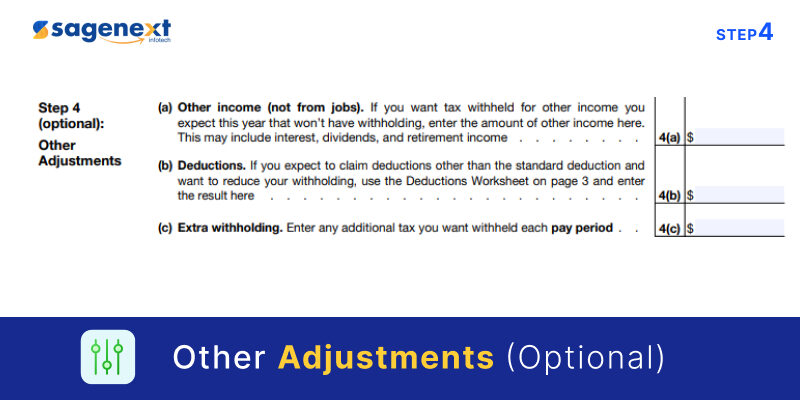

- Other Adjustments: This section is optional, but it is beneficial for individuals who wish to make supplementary modifications, such as accounting for other income (such as investments) or deductions.

- Sign and Date: Execute and Date: Your signature is required to authenticate the form. Employers will not proceed without this step.

How to Fill Out IRS Form W-4 in 2024: Quick & Easy Steps

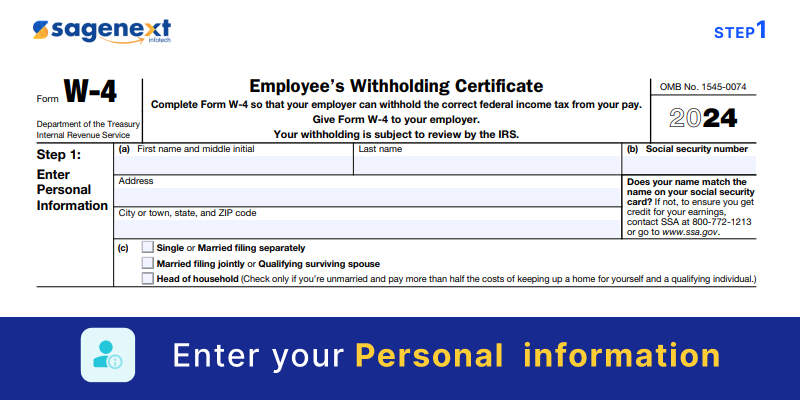

Step 1: Give Personal Information

This section requires your personal information. Here, you need to enter simple information like your full name, address, social security number as well as your tax filing status. The filing status (single, married filing jointly, etc) is also required here and is important as it affects your tax rates and other credits allowed on your return.

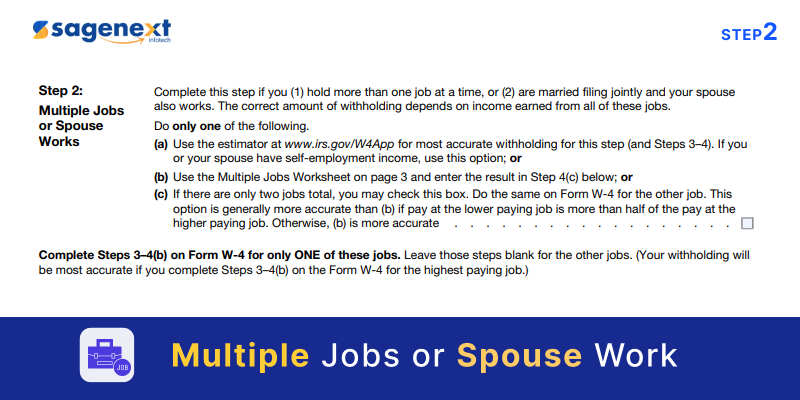

Step 2: Details of Multiple Jobs or Spousal Income

If you have another job or if both you and your spouse are working, you will need to provide details in this step. This section can help avoid underpayment of taxes especially when presented with a combined income. For additional precise estimates, you have the choice of using the IRS’s Tax Withholding Estimator or completing the Multiple Jobs Worksheet on the form.

Step 3: Claim Dependents

For those whose adjusted gross income is $200,000 or below ($400,000 if married filing jointly), you can benefit from credits for children and dependents. Take the number of children under 17 years of age, multiply it by 2000 and other dependents by 500 then fill the total in the form.

Step 4: Adjustments and Additional Withholding

This step is optional and gives the user a chance to make the most accurate estimations of the values to be withheld from taxes. If you receive any income other than your wages, salaries, etc that is not taxed by withholding, for example dividends or retirement benefits, you can report it here If you are planning to claim itemized deductions you will also report it here. You can also make an additional estimated tax payment or request that more tax be withheld, if you prepare to owe more tax when you file your tax return in the following year.

Step 5: Sign and Date

Do not forget to put your signature and the date at the indicated areas in the form. Simply put, if you don’t fill in the form with your signature, the form is useless, and your employer will take tax as if you have no dependents and are single.

Access Your W-4 Form PDF Here: (https://www.irs.gov/pub/irs-pdf/fw4.pdf)

Who Must File Form W-4?

- New Employees: Form W-4 must be completed by new employees: When you start a new job, your employer will require you to complete a W-4 form to establish the proper withholding.

- Current Employees with Changes: If your financial situation changes, such as getting married, having children, or earning additional income, you may want to update your W-4 to reflect the new circumstances and modify your withholding to reflect the changes.

What Happens if You Don’t Fill Out a W-4?

If you don’t fill or make a W-4, then, by law, your employer will assume that you are single with no adjustments required to be done and therefore, the maximum amount of deductions will be made from your wages for taxes. This can lead to overpaying on your taxes for the whole year if proper management is not done. While this means you can expect your refund, you might not get the chance to have extra take-home pay.

On the other hand, under withholding because the form W-4 has been filled in a wrong manner could lead to an unexpected tax bill or amount payable to the IRS when preparing the tax return.

Common Mistakes to Avoid When Filling Out Your W-4 Form

- Failing to Update Important Details: In case you go through some significant changes in life or new role & responsibilities to adhere to like marriage, a divorce, or if having a child, then you should fill a new W-4 to properly define your new financial status.

- Not Adjusting for Multiple Jobs: It is imperative to adjust your withholding in accordance with the number of jobs you or your spouse hold. Otherwise, you may not have sufficient tax withheld.

- Ignoring Non-Wage Income:If you possess substantial non-wage income, such as dividends or interest, and fail to modify your withholding, you may incur tax liabilities at year-end.

Do I Claim 0 or 1 on My W-4 Form?

The amount of taxes withheld from your paycheck depends on whether you claim 0 or 1 on your W-4:

- Claim 0: If you claim ‘0’ allowances, an additional amount extra tax will be deducted from your paycheck. If you are seeking to avoid a tax charge, this is a safer alternative; however, it may result in a larger tax refund.

- Claim 1: Your take-home pay will be marginally higher if you claim the “1” allowance since less tax will be deducted from your paycheck. However, when you file your return, you risk owing additional taxes.

Choosing the right option depends on your needs and upon your personal situations. To prevent incurring tax liabilities, it is advisable to claim zero allowances, particularly if you own supplementary income or other untaxed earnings.

Changes to Form W-4 for 2025

The 2024 Form W-4 is very much similar to the previous version forms that had been introduced in recent years. However, few notable changes and updates have been incorporated that being:

- The form is now more transparent as it no longer uses allowances.

- To assist employers and employees in precisely calculating withholding, new tables and calculators are provided.

- Easier adjustment options for taxpayers have been introduced who have dependents or are serving more than one job.

How to Submit the W-4 Form to Your Employer

After completing the form, you need to give it to your employer. It can be either filled in the hard copy and submitted in person or completed online if it is provided by your employer.

Tips for Filling Out Form W-4

- Use the IRS’s Tax Withholding Estimator: This tool enables one to be able to predict the right amount of tax that needs to be remitted thereby avoiding over or under withholding.

- Review Your W-4 Annually: Any changes that occur in life like marriage, having children or switching jobs as well as getting a second job should be considered the time required to review your W-4 form and if required file a new one to remain updated and accurate with proper tax filings

- Consider Extra Withholding: In case of any doubts regarding underpayment of taxes, one may ask his employer to deduct more amount from the paychecks.

- Seek Professional Advice: If there is some doubt as to how to complete the W-4 or how one’s tax situation is going to impact his paycheck then it may be beneficial for one to seek any expert advice or take services of a professional tax consultant.

What if You Want to Adjust Your Withholding?

You can always complete a new W-4 form and provide it to your employer in order to modify your withholding. It is helpful if you would like adjustments of more or less tax according to your paychecks so that you have either a large refund when filing your taxes or additional amount in your paycheck in the course of the year. It is also important to know that you can always complete a new W-4 form if ever you have reconsider your withholding on your paycheck and taxes. Settings in Step 4 (c) entails the provision for more withholding to be made which is useful in avoiding a tax bill during the year end.

Why Accurate Withholding Is Important?

Timely and appropriate deductions let you know exactly how much you’ll owe when it’s time to file your taxes. Over-withholding implies that the government receives an interest-free loan, while under-withholding may lead to a huge amount of tax liability and potential underpayment penalties.

Conclusion

Filling out the 2024 Form W-4 becomes essential for employees since it determines how much federal income tax is deducted from their paychecks. Despite recent simplifications, it is still crucial to carefully check the form, particularly if you have multiple employment, dependents, or other sources of income.

Following the instructions in this tutorial will help you make sure that your withholding is correct and lower the possibility of either an overpayment or an underpayment. Remember that maintaining your W-4 form up to date is vital for efficiently managing your tax status.

FAQ:

What is a W-4 form used for by the IRS?

Employees use a W-4 form to inform their employer of their tax withholding preferences. The IRS uses this information to determine how much federal income tax should be withheld from the employee’s paycheck. This ensures accurate tax payments and helps avoid underpayment or overpayment at tax time.

How to fill out a W4 for dummies 2024?

- Personal Info: Enter your name, address, Social Security number, and filing status (single, married, etc.).

- Multiple Jobs or Spouse Works: If you or your spouse have multiple jobs, there’s a special section to adjust withholding.

- Claim Dependents: Claim any dependents you have (children, etc.) to reduce the amount of tax withheld.

- Other Adjustments: If you have other income sources or want to adjust your withholding, there are options too.

- Sign and Date: Sign and date the form to make it official.

Should I claim myself as an exemption on W4?

No, it’s not advisable to claim you’re exempt on your W-4 unless you meet specific criteria. Claiming exemption means your employer won’t withhold federal income tax, which could lead to a significant tax bill or penalties when you file your return if you owe taxes. Ensure you qualify before choosing this option.

written by

written byAbout Author