What is Schedule 2 Tax Form Steps and How to Fill It? (IRS 1040)

Schedule 2 is a supplementary form used in the United States for reporting additional taxes that are not included in the main Form 1040. This form is necessary for taxpayers who owe taxes beyond the standard income tax.

What is IRS Form 1040 Schedule 2?

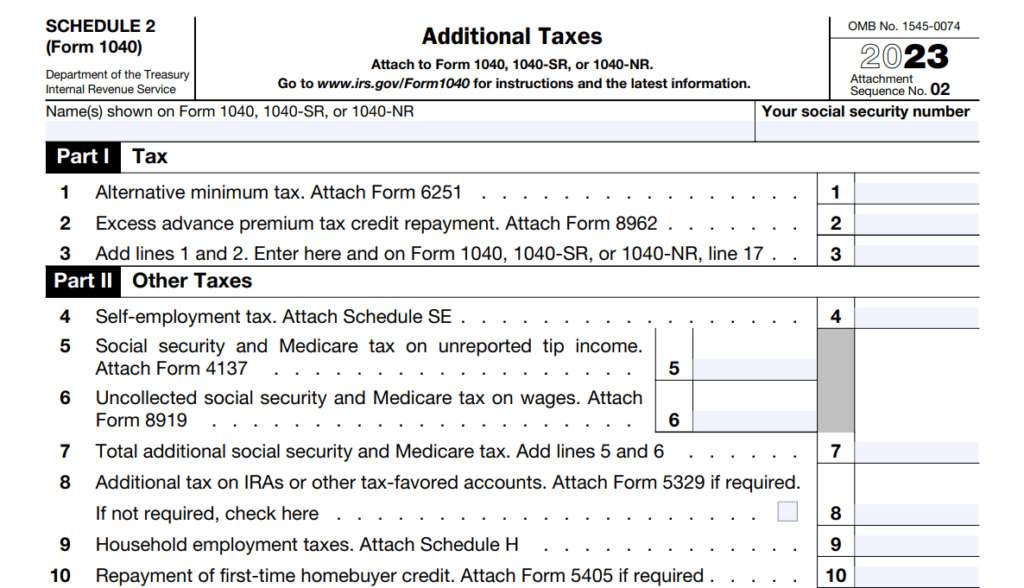

IRS Form 1040 Schedule 2 is an additional form attached to Form 1040 for reporting various types of additional taxes, such as self-employment tax, household employment taxes, and certain other taxes. It’s divided into two parts: Part I – Taxes and Part II – Other Taxes.

Part I – Taxes:

Part I of Schedule 2 is dedicated to reporting additional taxes owed, such as self-employment tax and uncollected social security and Medicare tax on tips or group-term life insurance. Taxpayers who owe these types of taxes must accurately report them in Part I of Schedule 2.

Part II – Other Taxes:

Part II of Schedule 2 covers other taxes that don’t fit into the categories listed in Part I. This includes taxes such as the Additional Medicare Tax and the Net Investment Income Tax. Taxpayers subject to these taxes must report them accordingly in Part II of Schedule 2.

Who needs to file Form 1040 Schedule 2?

- High-Income Taxpayers with Alternative Minimum Tax (AMT): If your income falls above certain thresholds, you might owe AMT, a separate tax system calculated differently than your regular income tax. Schedule 2 is where you report and pay it.

- Health Insurance Marketplace Repayment: Did you receive an advance premium tax credit for your health insurance through the marketplace, but your income later changed? You might need to repay some of it. Schedule 2 helps you do that accurately.

- Self-Employed Individuals: Running your own business means you’re responsible for your own Social Security and Medicare taxes. Schedule 2 is where you calculate and report these “self-employment taxes.”

- Household Employers: If you have someone helping you around the house, like a nanny or housekeeper, you might owe payroll taxes for them. Schedule 2 helps you handle those.

- Unreported Social Security and Medicare Tax: Did you receive income where Social Security and Medicare taxes weren’t withheld, like tips or certain business income? Schedule 2 helps you catch up on those taxes.

- Additional Taxes on Retirement Plans: Withdrawing money early from certain retirement accounts can trigger additional taxes. Schedule 2 is where you report and pay them.

- Net Investment Income Tax: If your investment income exceeds certain thresholds, you might owe this additional tax. Schedule 2 helps you calculate and report it.

Also Read: Everything You Need To Know About Small Business Tax Forms

How to fill out Form 1040 Schedule 2?

Filling out Form 1040 Schedule 2 might seem daunting, but it’s actually quite manageable with the right guidance. Here’s a step-by-step approach to help you navigate it confidently:

Step 1: Gather Your Documents:

- Tax Forms: Have your Form 1040 and any relevant supporting documents like W-2s, 1099s, K-1s, and receipts handy.

- Instructions: Download the official IRS instructions for Schedule 2 (Publication 17). It clarifies each line and provides examples.

- Tax Software: Many tax software programs automatically generate Schedule 2 if needed based on your information. This can streamline the process significantly.

Step 2: Identify Applicable Sections:

Schedule 2 is divided into two parts

- Part I – Taxes: This covers taxes like self-employment tax, household employment tax, alternative minimum tax (AMT), and others.

- Part II – Other Taxes: This section includes taxes on IRAs and retirement plans, net investment income tax, unreported Social Security and Medicare tax, and more.

Review each section and determine which lines apply to your tax situation based on your documents and income sources.

Step 3: Fill Out Each Line Carefully:

Each line has specific instructions. Consult the official instructions and your tax documents to ensure you enter the correct amounts. Here are some key tips:

- Double-check All Numbers: Ensure they match your records and statements.

- Use Clear and Legible Handwriting: If filing paper forms, write neatly to avoid errors.

- Attach Relevant Forms: If instructed, attach any related forms or worksheets mentioned in the instructions.

Step 4: Review and Submit:

Once you’ve completed all applicable lines, carefully review your entries for accuracy. Use the tax software’s review function if available. Ensure all numbers are correct and all required information is provided.

Finally, follow your chosen filing method (electronically or by mail) to submit your Form 1040 with the attached Schedule 2, if applicable.

Conclusion:

Understanding IRS Form 1040 Schedule 2 is essential for accurate filing, especially for individuals with additional tax obligations beyond regular income tax. By familiarizing yourself with the purpose of Schedule 2 and following the instructions provided by the IRS, you can ensure compliance and avoid potential penalties. If you’re unsure about whether you need to file Schedule 2 or how to do so correctly, consider consulting with a tax professional for personalized guidance.

FAQ’s:

What is Schedule 2 on a tax form?

Schedule 2 is an additional form attached to IRS Form 1040 for reporting various types of additional taxes beyond regular income tax.

What to do if you don’t have Schedule 2 for FAFSA?

If you don’t have Schedule 2 for FAFSA (Free Application for Federal Student Aid), you may not need to report additional taxes. However, it’s essential to consult with a tax professional or the IRS for specific guidance.

What is the difference between 1040 Schedule 1 and 2?

While both Schedule 1 and 2 are additional forms attached to Form 1040, Schedule 1 primarily covers additional income sources and adjustments to income, while Schedule 2 focuses on reporting additional taxes owed.

Who must file Schedule M 2?

Schedule M 2 is used to report certain tax credits, and individuals who qualify for these credits must file this schedule along with their tax return.

written by

written byAbout Author