Every year, most business owners face a dilemma and have to ask themselves, “Should I do my own taxes or should I hire a tax preparer?” The problem with self-prepared taxes is that people spend long hours gathering the right documents. They may even make mistakes if they aren't conversant with what goes where.

With the advancement in technology, many business owners are choosing to work smart instead of working hard. Because time is valuable, they prefer to pay a tax preparer to do the paperwork while they concentrate on prospecting and making profits.

The IRS recorded that 84,924,000 people paid tax professionals to file tax returns for the 2021 Tax Year. This figure shows a 5.4 percent increase compared to 2020. Tools like tax preparation software can help accountants prepare taxes faster and file e-forms without error.

So, if you're eager to help clients to work smart, you should be willing to embrace solutions that make complicated issues appear simple. One of such solutions is the Intuit ProSeries tax software. In this article, I will tell you all you need to know about the software and how it can benefit you and your clients.

What is Intuit's ProSeries Tax Software?

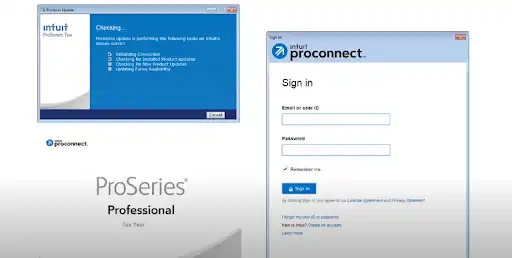

The ProSeries tax software is one of Intuit's products, the makers of QuickBooks. It offers a virtual office for tax preparation. You can quickly input your data and the tool will automatically calculate and e-file your taxes. If there's an error while filing taxes, the tool will track it and alert you.

The software is basically designed for accountants. However, Intuit provides video tutorials, webinars, and live training that makes it easy for you to navigate the dashboard and serve your clients better.

How to Download Intuit ProSeries Tax Software?

To download the ProSeries Tax software, do the following:

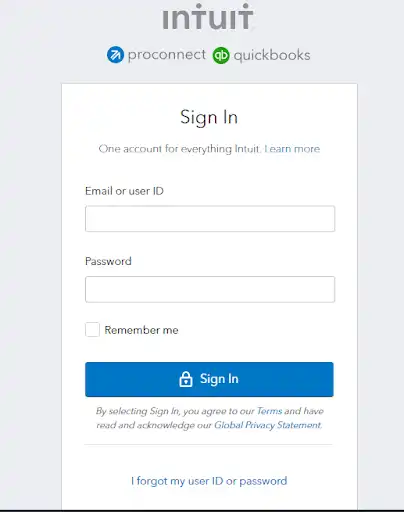

- Create an Intuit account or sign in to My Account if you already have an account.

- Enter your user name or Email

- Enter your password

- Click on “Sign In”

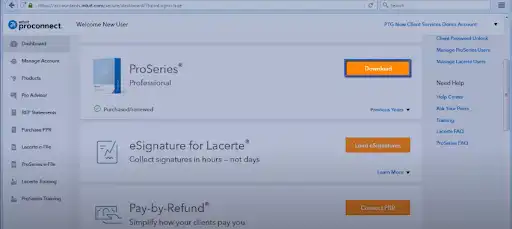

Once you've logged in, a dashboard will display. Select the download button for ProSeries.

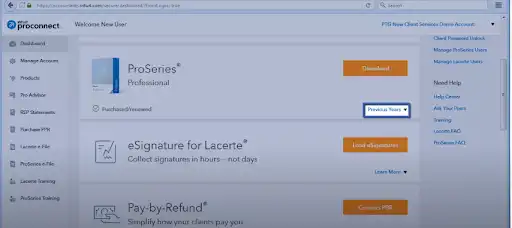

If you want to download prior versions of the software, select “Previous Years” just below the download button.

Depending on your web browser, you may be notified to “Run”, “Save”, or “Open” the download file before the installation begins.

The initial welcome page will appear on your screen. Select “Next” to begin the installation process.

Review the license agreement, then select the “I accept terms of the agreement” radio button.

Select “Next”

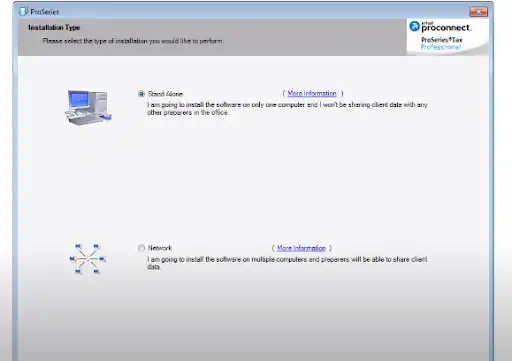

The Installation screen will prompt you to select either a Stand Alone or a Network installation.

For “Network”, ensure the computer you're using is the one that you're giving the administrative rights. Select “Network”, then click “next”

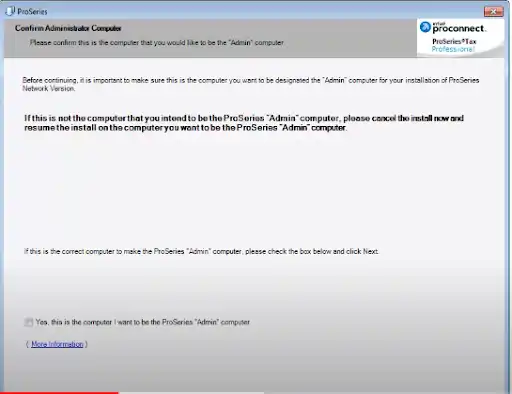

The confirm administrator window will be displayed. Click the box that reads, “Yes, this is the computer I want to be the ProSeries admin computer”. Select “Next” to continue.

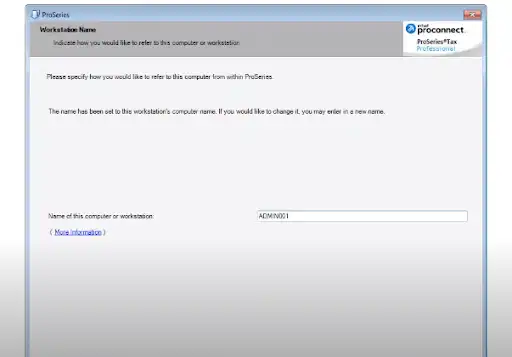

The workstation name screen will display the name of the computer you're using for the installation. You can change the default name. Click “Next” to continue.

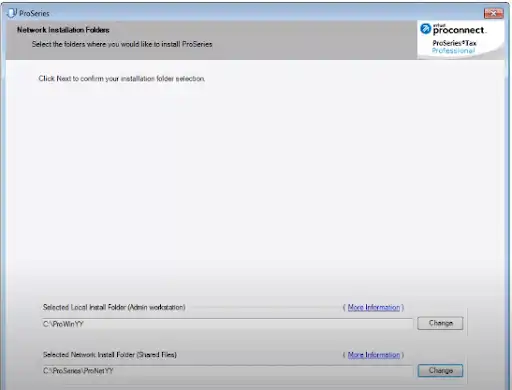

On the network installation folder screen, the local install folder and network install folder fields will display a default location on the hard drive of the computer you're using.

Change the path for the network install folder to that of your server if you're using a client-server environment. If you're using a P2P environment, leave the default pathway as it is. Click “Next”.

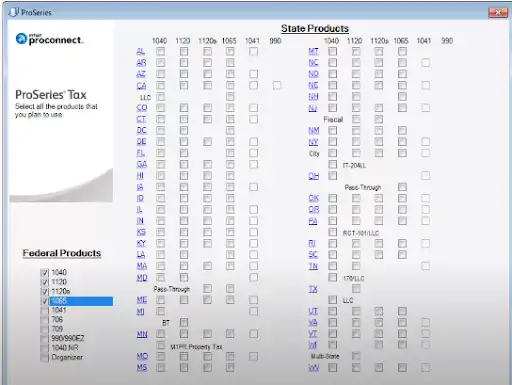

On the products screen, select the Federal products and the State you will work with. Ensure you select just the items that you need. If you check all the boxes, it will take a longer time to install the software.

Select “Next”. The selected products will begin to download.

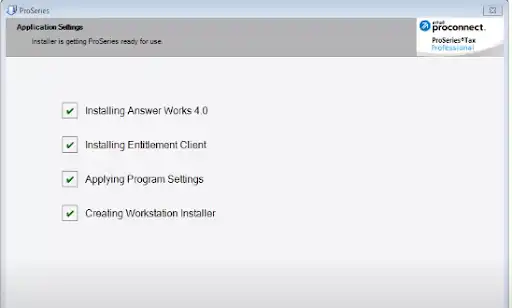

The application settings screen will appear and automatically install key components for the program.

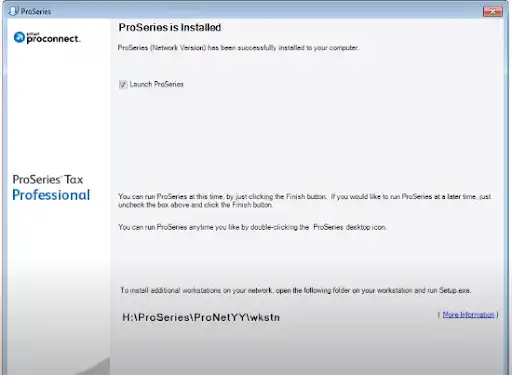

Once the program has been installed, the “Launch ProSeries” check box will be selected. Click “Finish” to launch the program.

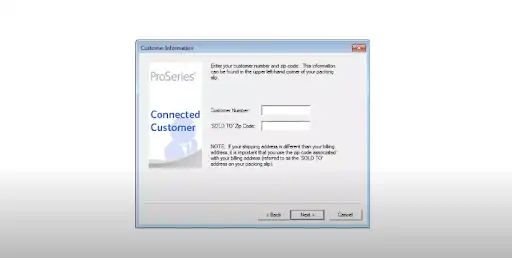

When the program launches for the first time, you will need a license. Click “Next” to continue with the licensing wizard.

Enter your customer number and “SOLD TO” zip code, then click “Next”.

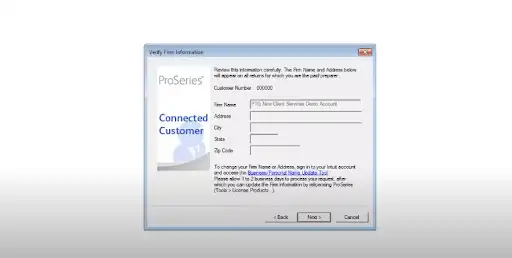

The wizard will connect to the Intuit server to confirm the information you provided. Click “next” after the confirmation process is completed.

The verify firm information screen will display your company's information as it will appear in your tax returns. Verify the information, then click “Next”. If the information is incorrect, click on the “Business/Personal Name Update Tool” link to make the necessary corrections.

The product licenses screen will display the products that your company is licensed to use. Click the “Continue” button.

The ProSeries program will now launch and you can sign in to start using the software. The program will also check for updates that will run in the background while you're setting up the software.

After logging in, follow the prompts to set up the software and save the updates.

Types of ProSeries Software

The ProSeries software offers two packages: basic and professional. The Basic package is for entry-level accountants or people who want to file their personal tax returns, while the professional package is for experts who handle both individual and business tax returns.

Intuit's ProSeries Basic Edition

Intuit's ProSeries Basic edition is for individuals. You can easily navigate the user interface as well as invite your client to collaborate with you on the software. Intuit offers 3 plans in the ProSeries Basic edition. They are Basic 20, Basic 50, and Basic unlimited.

Basic 20

If you're new to accounting, this is the place to start. Invest $519 per year and Basic 20 will give you access to 20 1040 returns; the standard tax return form for filing individual taxes in the U.S. The plan also gives you access to 20 individual returns in a single state. You can file additional business returns and State and Federal returns at an extra cost.

With Basic 20, e-filing is free and you can easily see the statuses of all your clients in one screen, known as the HomeBase. The workflow is also guided to keep you organized, from the general information clients provide to specifics such as credits, income, and so on. The information of each client is saved in a portal, which Intuit provides free of charge. This speaks of convenience because you can easily extract the information of any client without searching through every single file in the portal.

Because beginners tend to get confused when handling new processes, Basic 20 allows you to select the data you want to input. Using this information, the software will take you directly to the form that you need.

You can access and download the current Tax Year's data of over two hundred and seventy-five financial institutions. You can also access pay-per-return for the previous year.

Basic 20 supports electronic signature at an additional fee. Once you sign up, you will get 5 free e-signatures. Afterward, you can pay $2.99 per folder or $124.50 for 50 folders. And if you want to enjoy unlimited access, you will pay $1427.

Basic 50

This plan costs $799 per year. You can file 50 Federal 1040 and State returns (for 2 states only). But you can pay an extra fee to add more states. The plan offers free e-filing and supports over 1000 forms. There's also a guided workflow and a HomeBase to help you stay organized.

It features a tax planner and a direct download of data from over 275 financial institutes. Basic 50 also supports electronic signatures.

Basic Unlimited

For unlimited access to all that the ProSeries Basic edition offers, simply pay $1259. You will have unlimited access to Federal 1040 and State returns (for only 4 states). You will also have access to the other features in the Basic edition which includes:

- Free electronic filing

- Electronic signature

- Tax planner

- Access to over 1000 forms

- A guided workflow and HomeBase

- Financial institution download

Generally, all plans in the ProSeries Basic edition offer a free trial. As a new customer, if you aren't satisfied with the product, you can request a refund within 30 days of using it.

Intuit offers an onboarding program to enable new customers to start off on the right foot. This program features the following:

Automatic Data Conversion

If you were using another tax preparation software and intend to migrate to Intuit's ProSeries, the software can help you to convert your data from the previous Tax Year. This process will only move selected items, not everything. These items include:

- Personal information such as the taxpayer's name, name of spouse, and names of dependents.

- Names of businesses, partners, interests, or estates.

- Carryover amounts

- Depreciation

The conversion process will not cover the following:

- 5500, 990, 709, or 706 items.

- Carryover amounts that were not stated in the previous tax preparation software.

- Amounts that do not apply to the current Tax Year preparation.

- State data such as tax refunds and differences in depreciation for different Tax Years.

Technical Support

ProSeries offers technical support for new customers. The customer care agents have a vast knowledge of the software. So, when you call for help, don't expect them to transfer your call.

Training Portal

This is where you will find all training modules that are relevant to the plan you signed up for. You can also attend webinars or get notifications of free live training that will take place around your location.

Success Guide

Intuit will give you the information that you need and at the time when you need it. After signing up, you will receive emails that explain the download and installation processes. You will also get a checklist that will guide you through data conversion, electronic filing identification number verification, and other steps for setting up the ProSeries software.

Intuit's ProSeries Professional Edition

The ProSeries professional edition helps accountants to prepare taxes for medium to large companies. It is also suitable for individuals with a high tax preparation need. It features 4 plans: Pay-Per-Return, Choice 300, 1040 complete, and power tax library.

Pay-Per-Return

As the name implies, this plan is a pay-as-you-go option. The plan costs $369 but you will pay $49 per 1040 Federal return and $46 per State return. It provides tools that facilitate your work with clients, giving them the best value for their money. These tools are client advisor, checklist, and presentation.

Additionally, you will have access to the following:

- Free electronic filing

- Direct financial institution download

- Pay-per-return for the previous Tax Year

- Intuit Link portal for organizing your clients' information

There's an option for hosting the Per-Per-Return on the cloud. It costs $120 per month for 1 to 3 users and $99 per month for 4 or more users. Hosting for ProSeries include the following:

- Complete data conversion

- Customized onboarding process

- Unlimited storage space for tax data

- Remote access to files

- Integrate 28 business applications such as Fixed Asset Manager, Google Chrome, e-Signature, and TaxWork Flow.

ProSeries Choice 200

This plan is only available to new customers who prepare up to two hundred returns for clients with various tax needs. It supports 706, 709, 990, 1041, 1065, 1120, and 1120S Federal, State, and gift and estate returns, including 1040 NR and 1040. When you exhaust the first 200 returns, you will pay $46 per State return.

Choice 200 supports e-filing, cloud hosting, and e-signature for form 8879. It also gives access to client service tools and multiple users. The juicy part of this deal is that you will get free access to a client organizer, a product that costs $345. To subscribe to this plan, contact 855-512-5977 for the price.

1040 Complete

This plan is suitable for people who prepare more than 30 1040 Federal and state returns. It costs $1999 per year with an unlimited number of the 1040s but you will pay $46 per State business return and $49 per 1040 NR.

You can host the plan on the cloud and invite multiple users to share the software with you. E-filing is free and you will have access to client service tools, Intuit Link portal, and direct financial institution data download.

Power Tax Library

The ProSeries power tax library offers unlimited 1040, 706, 709, 990, 1041, 1065, 1120, and 1120S Federal, State, and gift and estate tax returns. It also offers free e-filing, e-signature, multi-user access, cloud hosting, and client service tools.

The plan gives you free access to ProSeries Client Organizer and Fixed Asset Manager. You can call 855-512-5977 for the pricing details.

What Are the Features of ProSeries Software?

The features of ProSeries software are as follows:

Integration for Additional Functionality

ProSeries integrates electronic signature into its software. This allows you to collect digital signatures of clients and track the real-time progress of documents from your ProSeries home page.

You can directly import financial data from QuickBooks or convert selected data from any other tax software you were using. You can also download financial data, such as 1099-DIV, 1099-B, and 1099-INT, from supported financial institutions.

ProSeries professional edition supports cloud hosting for people who prefer to work remotely. It also saves time, cost of purchasing IT infrastructure, and reduces the need to maintain hardware. The cloud-hosted version has in-built security and automatically backs up your data. It also allows you to collaborate with your team members in real-time.

ProSeries professional allows you to directly import assets like schedule C and E from Fixed Asset Manager. It also offers a SmartVault for managing clients' data through an integrated client portal.

Easy Data Entry

Intuit tries to make its programs easy to use, so its tax preparation software allows you to input data easily by:

- Helping you to trace where a specific field data came from or to understand the type of data you should input in a particular field.

- Offering constant help while working such that you won't have to move out of the current screen. Intuit has an online resource center where you can obtain any information you need.

- Ensuring that you identify the right fields for your data as well as the correct forms to use. Sometimes, you might get confused about which form to use for the different data sets your clients provide, this feature can assist.

- Allowing you to undo mistakes during data entry or revert to the previous data you entered using the redo feature.

ProSeries basic edition offers assistance in 3 areas:

- Forms tab

- Navigation on the dashboard for selecting data categories

- Checklist for selecting the type of data you want to input

ProSeries professional edition offers the following:

- Forms bar for locating and fixing errors in data entry. It also guides data input for tax returns and helps you to locate tax forms with ease.

- Quick entry sheet for faster data entry. With this feature, you don't need to scroll through all the forms before selecting the exact one that you want.

- Split joint returns for creating separate returns for a taxpayer and their spouse.

Client Management

ProSeries has tools that enable you to efficiently manage all your clients from one screen. You can easily view, track, and manage your filed returns. You can also check the status of your clients' returns and use the information to plan for future events.

When filing a return, you can lock it to avoid changes in the calculation until your client has provided all the information you need. If ProSeries detects any updates, it will notify you so you can accept the changes and proceed with the e-filing.

The software has an in-built tax planner for estimating how much tax your clients will pay in the future, including their expenses, income, and withholding. It also has a client-advisor tool that suggests ways your clients can reduce their taxes.

To help you stay organized and prepare tax returns faster, ProSeries offers Intuit Link. It's a portal where clients can submit tax data in a timely fashion.

ProSeries Professional edition goes a step higher to offer more tools for client management. They include the following:

- Track missing data in a client's return, quickly send an email to the client, then update the data field.

- Create a checklist for the current year's return using the previous year's return as a guide.

- Bill clients according to their preference. You can charge a fee for each form, or set an hourly fee or a flat fee. The software has an electronic invoice that you can customize and a billing clock.

- Use pictorial tools like graphs and charts to compare a client's yearly income, expenses, and taxes.

What Are the Benefits of ProSeries Software?

Intuit's ProSeries software offers the following benefits:

Accurate and Fast Calculation

Accounting involves a lot of calculations and there's the tendency of making mistakes as humans. The ProSeries software automatically calculates returns using the data provided in order to eliminate human errors. This also helps to shorten the time it takes to prepare taxes, making you more efficient.

Enhanced Clientele Communication

Intuit's ProSeries has an improved means of communicating with clients. Through the Intuit Link, your clients can submit documents faster. You can also share data with them on the portal. This helps you to organize each client's data without getting confused.

Also, if the client did not provide all the information you need for e-filing, you can easily email them through the platform. As soon as they upload the document, Intuit will notify you to update the form you were working on.

Saves Time

If tax preparation software does not help you to save time spent on processing tax returns, then it isn't worth using. This is not the case with ProSeries as it takes away the stress of entering data repeatedly.

For instance, if you've entered a client's data in a particular field, the software will automatically generate that data when you need to fill the same field in another form.

The software has other features that also help you to save time. For instance, it can help you to locate the type of form you want. It can also help you to identify and fix errors as well as missing fields during data entry.

Cost-Effective

Compared to other tax preparation software, ProSeries offers great features at a reasonable price. You can pay per annum or pay-as-you-go. The company also offers discounts to new customers and free trials with access to all the program's features.

For instance, if you sign up for electronic signatures, you will receive 5 free e-signatures. Also, if you purchase ProSeries Professional, you will have access to Client Organizer and Fixed Asset Manager. You can subscribe to these services differently, but Intuit gives them to you for free.

Top Add-ons For ProSeries Tax Software

ProSeries allows you to integrate multiple add-ons to enhance your workflow. Below are some of the top add-ons.

Cloud Hosting

ProSeries Professional edition has the option of connecting to the cloud. This means that you can access the software from your desktop and any other location. You can also grant multi-user access to your team members so you all can review files together without interruptions.

E-Signature

When filing tax returns, you can quickly request the signature of your clients. Your clients can view the request from any internet-connected device and sign with just a few clicks. Intuit will notify you as soon as they sign on the documents.

You can also keep track of the status of each request. You can see whether the request has been sent, completed, partially completed, or deleted.

Pay-by-Refund

Some clients can't pay for your services upfront but with pay-per-refund, they can pay from their refund. You can receive payment via direct deposit, check, or pre-paid card. The sign-up process is easy and quick.

To avoid identity theft, when your clients choose pay-per-refund, they are automatically enrolled in Intuit's identity theft protection program. This gives them access to identity restoration, identity theft insurance of up to one million USD, and 24/7 fraud resolution support.

Document Management System (DMS)

ProSeries document management system helps you to go paperless and improve your efficiency during tax preparation. You can quickly scan documents and store them on your computer. You can also share documents via email or fax directly from your computer.

Intuit Quick Employer Forms Accountant

This web-based tool allows you to generate payroll forms (1090s and W-2s) for your clients' employees and contractors by answering simple questions. You can review the forms and then Intuit will e-file them to the IRS. Afterward, you can print and mail them to the recipients.

Intuit Link

This portal helps you to quickly collect data from your clients by sending them an invitation to use Link. You can also track the status of the request as well as follow up if necessary. When the request has been completed, you will receive a notification to import the data. The portal is secure as Intuit ensures that all messages are encrypted.

Tax Scan & Import

With a few clicks, you can import data from a scanned document. ProSeries tax scan & import also has a form reviewer tool that allows you to edit data before importing. It supports W-2s, 1099s, 1098- mortgage, schedule K (1065, 1041, and 1120-s), and consolidated brokerage statements. Intuit uses 128-bit encryption to ensure that your data is secure.

What Makes Intuit ProSeries a Good Tax Software?

Here's what makes Intuit ProSeries a good tax software:

- It has a user-friendly interface.

- It identifies errors quickly and alerts you to fix them.

- It has an automated calculation feature.

- It offers 24/7 technical support, an online resource center, and an online community for peer-to-peer support.

- It offers free e-filing.

- It offers a 30-day free trial

- You can skip the process of scrolling to look for forms by using the quick entry sheet.

- You can use it on your desktop or opt for cloud hosting.

What is ProSeries Document Management System?

ProSeries document management system (DMS) is the storehouse of all your clients' tax documents. It reduces the need for papers since everything is done within the system. You can do the following with the ProSeries DMS:

- Create folders and sub-folders for your clients.

- Import clients' data from the ProSeries tax software.

- Annotate documents and send them to clients via email or fax.

- Protect documents with passwords.

Who Are the Typical Users of Intuit ProSeries Tax?

Intuit ProSeries tax software is generally used by accountants who help taxpayers to prepare their tax returns. Whether you are an entry-level or expert tax preparer, the software makes it easy for you to file taxes faster and with ease.

Additionally, if you're a freelancer or want to file your tax on your own, the software is easy to use. It helps you to find the exact form you want, suggests the right data you should input in each field, and does all the calculations for you.

What is ProSeries Software Plans

ProSeries software plans are: Basic and Professional. The Basic plan prepares only 1040 forms while the Professional plan prepares 706, 709, 990, 1065, 1041, 1120S, 1120 Federal, State, and gift and estate returns. Also, the Basic plan does not offer cloud hosting. You can only access the cloud package when you subscribe to any of the sub-plans in the ProSeries Professional plan.

What Are the Pros and Cons of ProSeries Tax Software?

Pros

- Easy to use

- Auto calculates returns

- Saves time

- Suitable for both entry-level and expert accountants

- Paperless options

- Offers free trial

- Free e-filing

- Digital signature

- Offers cloud hosting option

- Multiple add-ons for an improved workflow

- Affordable plans

Cons

- You can't file business returns or get cloud hosting in the Basic plan.

- Discounts are only available to first-time users.

What Are the Alternatives of ProSeries Tax Software?

Drake Tax

Drake tax can be used on the desktop and in the cloud. It helps professionals to prepare Federal and State returns quickly and more efficiently. You can import W-2s, end-of-year balance, and schedule D. You can also export 8615 and K-1s.

The software auto-fills entries and tracks the source of calculated results on returns. You can also accept payments from clients within the software. Drake tax supports e-filing and e-signature.

If you file less than 85 returns in a year, you may want to try Drake's Pay-per-return option. It costs $345 for 10 returns. Afterward, you will pay $29.99 per return. After completing the 85th return, you can convert to the unlimited bundle for free.

TaxCloud

This software is cloud-based and it is designed for managing sales tax for online businesses. TaxCloud supports filing for up to 25 states in the US. You can get detailed reports of your Tax Years as well as import or export tax data.

The software automatically calculates sales tax and ensures you stay compliant. It integrates with 3rd party apps like QuickBooks, WordPress, WooCommerce, Shopify, and so on. Its pricing starts from $10 per month.

TaxACT Business

TaxACT offers both on-premise and web options. It notifies you of missed opportunities and missing data that might result in expensive mistakes and huge deductions. Its basic features include free e-filing, audit management, and automated tax calculation.

Additionally, TaxACT offers free Federal editions for both desktop and web platforms. It allows you to utilize the basic features of the software for free. You can also access the State editions at $14.99 per return.

If you prefer to prepare your tax returns by yourself, you can get the Deluxe edition at $12.99. It offers professional advice and you can file one federal return for free.

TaxJar

TaxJar is another cloud-based platform that helps businesses to stay manage sales tax. Its features include auto filing, real-time calculation, sales tax reporting, and integration with ERP and e-commerce platforms such as NetSuite, Shopify, WooCommerce, and Stripe. Its pricing starts at $19 per month but you can try it for free.

What Are the Limitations of ProSeries Tax Software?

The major limitation of ProSeries tax software is the delay in getting a response from the customer service. The call lines are usually busy and you may have to wait for two days or more to finally get a response. Although Intuit encourages users to ask questions on the online forum, a lot of serious issues may get lost in transmission.

For instance, you may post a question and while a ProSeries user tries to answer that question, another user develops more questions from your own issue. In the end, the forum is divided. Rather than focusing on solving your problem, every other person brings their own problems to your post.

Is Intuit's ProSeries Cloud-Based?

Intuit ProSeries Professional edition offers cloud access for people who want flexibility. Here are the benefits of getting ProSeries cloud hosting:

Increased Productivity

Switching to the cloud means that you can work from anywhere. You can also grant access to your clients or staff members for collaboration. This keeps everyone on the same page, makes you more accountable as your clients can see what you're doing for them. It also increases productivity because you and your team are not limited by time or location.

Uninterrupted Workflow

Natural disasters like floods and storms can affect operations, leading to loss of revenue. Other things that can result in downtimes are system crashes and malfunctioning software. However, this is not the case with cloud hosting.

Hosting services have duplicate servers that ensure you do not go out of business when there is a technical problem. Even if your device seems to be the problem, you can switch to another device that is connected to the internet.

No Infrastructural Maintenance

When you install software on your local network and give access to other users, you might run into problems later. Because of the number of people using it at the same time, you need to maintain the server to reduce outages or downtimes.

Purchasing and maintaining IT infrastructure is no joke. It takes a lot of money out of your pocket. You also need to hire IT professionals to monitor the network to identify potential problems. But when it comes to cloud hosting, the difference is clear. You don't have to maintain anything. The host takes care of the server maintenance.

Also, hosting is cost-effective because you only need to prepare taxes during the tax season. Afterward, you can discontinue the service until you need it again.

Multi-User Access

Some tax firms hire temporal staff during the tax season, so they require tax software that is flexible enough to accommodate regular changes. ProSeries cloud hosting supports multi-user access. You can remove and add users with just a few clicks. You can also assign and re-assign roles to each user.

Unlimited Add-Ons

If you're using ProSeries on a desktop, your local storage limits the number of add-ons you can use. If you install more than necessary, it will affect the performance of your computer. However, if you opt for cloud hosting, you are not limited to a certain number of add-ons. You can integrate as many applications as you want.

Security

If you're running ProSeries tax software on your local server, you are responsible for the security of your client's financial data. However, with cloud hosting, Intuit provides security by ensuring that all your documents and messages are encrypted. Its security team works 24 hours a day, 7 days a week, and 365 days every year to ensure that there is no security breach.

Conclusion

Filing tax returns is not one of those exciting tasks that business owners want to handle. It is time-consuming and better left for professionals. And to make the job easier and faster for tax preparers, they fall back on tax preparation software.

Good tax software should be easy to use, affordable, offer technical support, and calculate returns without errors. And if the software offers a cloud-hosted version, it's a plus. From all that we've discussed, Intuit's ProSeries tax software fits the description of good tax software.

It increases the effectiveness of tax preparers by offering better ways to manage data and quick processing of tax returns. As a result, accountants can process returns for more clients within a tax year. With the aid of ProSeries tax advisors, accountants can recommend ways their clients can reduce reductions and gain more returns.