If you are an American citizen with gainful employment, the Internal Revenue Service (IRS) expects you to pay taxes. An effective way to prepare taxes is by using tax software. While there's numerous tax software on the market, UltraTax CS, a product of Thomson Reuters, stands out.

What is Ultratax CS Professional Tax Software?

UltraTax CS is one of the tax and asset management products in Thomson Reuters's CS professional suite. It is designed for large firms that handle up to 250 tax returns each year.

The software is highly automated and has time-saving tools to make you more productive. You can access a complete list of forms for filing local, federal, and state returns, including 1040, 1120, 1065, and 1041. UltraTax CS can serve as a stand-alone program or be used alongside other programs in the CS professional suite such as eSignature and planner CS.

You can also integrate UltraTax CS professional tax software with Onvio, cloud-based software for managing your firm remotely. Onvio helps you to customize your workflow, collaborate with clients and team members, share data over a secure platform, and go paperless.

Types of Ultratax CS Professional Tax Software

UltraTax CS Express 100

UltraTax CS Express 100 is a basic plan for one user, particularly made for smaller firms. You can prepare and electronically file up to 100 individual federal 1040 returns, 10 state returns, and 25 business returns (990, 1120, 1065, 1041 only).

You can purchase UltraTax CS Express 100 online at $2500 per year. However, this offer is only available to new UltraTax CS customers.

Standard UltraTax CS

This is the comprehensive version of Express 100. It contains various features such as:

- Unlimited forms and entity types

- Unlimited tax federal and state returns

- Multiple users

- Virtual office

- Oil and gas module

The features you choose determine the pricing.

Features of Ultratax CS Professional Tax Software

UltraTax CS Professional tax software has powerful features for managing clients and preparing and filing tax returns. Let's discuss these features in detail.

Multiple Monitors

Multiple Monitors

Tax preparers work with a lot of data from different taxpayers. However, toggling between screens to review documents from a single taxpayer is hectic. UltraTax CS takes care of this by allowing you to view forms, inputs, and more on up to four different monitors at the same time.

Instant Prep Checklist

Instant Prep Checklist

UltraTax CS has a checklist that instantly gathers the data you want to extract from your client's previous year's tax return. This helps you to start the new Tax Year on the right foot. Imagine that you're repeating this task manually for each client. It will become too monotonous and boring.

Easy Data Sharing

Easy Data Sharing

Linking 1120S, 1041, or 1065 returns manually t0 the 1040 return takes time. Therefore, UltraTax CS's new method of sharing data automatically links returns using their ID numbers.

E-filing

E-filing

UltraTax CS supports electronic filing as well as other tools that monitor the process. You can see the status of the return and whether it is accurate or not. This way, you won't make mistakes when filing returns for clients.

Multi-State Processing

Multi-State Processing

If your clients are from the same state, filing their tax returns may not pose many problems. But when they are from different states, the process becomes complex.

UltraTax CS eliminates this complexity by providing an Apportionment grid for filing business returns and another grid for Schedule K-1 or C income from different states. With this feature, you can accept clients from different states and boost your revenue.

UltraTax CS 2020 Features

UltraTax CS 2020 Features

The new features of UltraTax CS include the following:

Connect Background Services: With this feature, you can automatically download and update UltraTax CS Data Entry and Bar Code Scan utilities.

If your e-filed return was rejected, you can now get help from the Help & How-to Center to troubleshoot the problem.

UltraTax CS no longer offers the Recall Transmitted Returns feature starting from 2019. This is because the IRS has a new pattern of accepting e-filed tax returns. Although the feature still appears on the CS Connect dialog of 2018 and older software, it is disabled.

UltraTax CS 2021 Features

UltraTax CS 2021 Features

The 2021 version of UltraTax CS comes with the following:

- Idea Incubation for posting suggestions for product improvement and upvoting the ideas of other users.

- UltraTax CS now integrates with SafeSend, a third-party tool for sending electronic copies of tax returns.

- The B&D screen has new fields for virtual currency transaction statements.

- You can import cryptocurrency statements from LukkaTax and Ledgible by Verady.

- New forms have been added: 461, 7203, 8915F, and 9000

- E-signature is now available for 1040X returns.

Benefits of Ultratax CS Tax Software

Here's why you should use UltraTax CS tax software:

No More Repetitive Tasks

No More Repetitive Tasks

Processing tax documents for clients involves a lot of redundant tasks. You have to create and duplicate data entries, making the work more difficult and time-consuming.

With UltraTax CS, you can easily get rid of all repetitive tasks through automated data entry. The software integrates with Onvio Firm Management, document management, and Workpapers CS to eliminate manual data entry processes. This way, you will complete returns faster and accurately.

Save More & Do More

Save More & Do More

Generally, businesses that use on-premise software spend money on purchasing and maintaining IT infrastructure. However, UltraTax CS is cloud-based, which means you won't need to spend money on all of that stuff. You also won't bother about setting up an IT team to take care of the office server and other work tools. Since the aim of every business is to maximize profits while reducing operational costs, UltraTax CS can help you save more money.

Real-Time Collaboration

Real-Time Collaboration

A typical tax firm has various CPAs reviewing the documents of clients here and there. But the office server does not encourage collaboration. Your team can't see the changes you're making on documents, so you have to explain things to them over and over again, which is stressful. And not everyone grabs instructions at a go. So the back and forth should be expected even if you resort to sending emails.

UltraTax CS bridges this communication gap by encouraging collaboration both in and out of the office. You can share and receive files in real-time as well as work on projects with your team from any location.

It's post-pandemic and everyone is trying to figure out how to become more efficient in a virtual work environment. Therefore, with UltraTax CS tax software, you can comfortably work from home and still remain productive.

How to Download & Install Ultratax CS Professional Tax Software

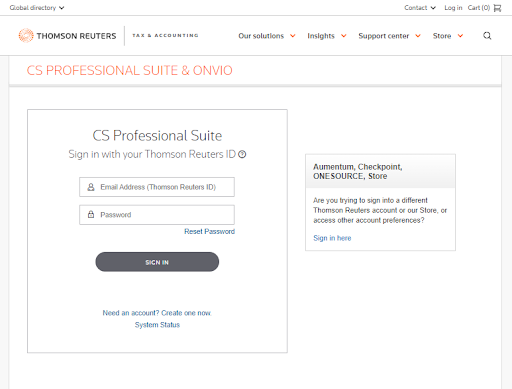

Downloading the UltraTax CS software is very easy. Follow these steps to get it done:

- Visithttps://cs.thomsonreuters.com/support/downloads/

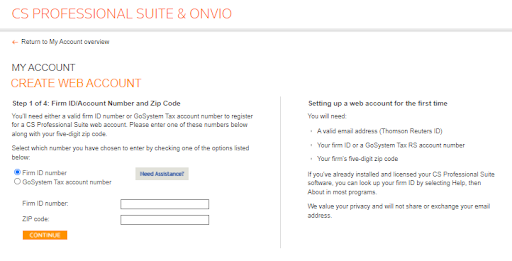

- Create a new account using your firm's ID number or GoSystem Tax account number. If you already have an account, enter your login details.

- Click on the download link. This will redirect you to a page, then click “Proceed” to start the download.

- Once the download is complete, your computer will prompt you to save or run the .exe file. Click “Save”.

If the file does not download, your operating system may require permissions. It might be an antivirus, firewall, or browser setting issue. In this case, contact your IT department or a professional.

To install the software, follow these steps:

- Go to your downloads or where you saved the .exe file.

- Double click on the file, then select “Run” to begin the installation.

- Select the “I accept the license agreement” button to continue the installation.

- A dialog box will pop up for you to input where you want to install the program, your firm's ID, and PIN.

- Check the “install products” box to install the UltraTax CS products you qualify for. If you don't have a license yet, uncheck the box.

- Select “Install UltraTax CS Product Group Licenses”

- Select “add desktop shortcut icons”

- Click “Install” to continue the installation.

- Click “Finish”.

How to Set Up Ultratax CS Professional Tax Software?

In the previous section, I showed you how to download and install the UltraTax CS software. Now, let's see how to configure the program so you can start using it.

- Click on the desktop icon to open the software.

- If you didn't install your license initially, click “Help” then select “About UltraTax CS”. You will see the “Download Licenses” button. Click on it to download and install your license.

- Next, install the available states, particularly those you work with. Thomson Reuters releases states in January. Until they are released, you won't be able to install them.

- Any updates on the software will download automatically. But you can download them manually.

To start processing returns, you must set up the following:

- Enter your company's EIN, fax number, and phone number.

- Create a profile for each user. Enter the user's name, contact, PTIN, and other required information.

- Select your preferred security settings. You can choose between standard and advanced. The standard password involves the use of a master password while the advanced goes a notch higher to include user groups and permissions for each user.

- Select your preferred location for data storage. You can either store it on the cloud, desktop, or both.

- Select your options for federal and state returns. These include the prices that will display on your invoice and print collations.

- Set up the EFIN of your firm for electronic filing

- Lastly, if you are converting from another software to the UltraTax CS software, the proforma utility will assist you with that.

UltraTax CS has other optional features that you may want to configure. They help to improve your workflow and make you more efficient.

- Select CS Connect options to automatically download updates to your software.

- Create a default user preference that applies to everyone using the software in your company.

- Create custom status events to track the status of your clients' returns.

- Customize printed returns.

- Use the SSN masking option to hide your clients' social security numbers.

- Automatically backup data to FileCabinet CS if it is included in your license.

How Does Ultratax CS Professional Tax Software Work?

UltraTax CS Professional tax software is quite useful to tax preparers. It assists them by:

- Eliminating repetitive tasks that lead to drudgery.

- Drastically reducing the time it takes to file returns.

- Ensuring that errors are spotted on time.

- Organizing taxpayers' information into categories.

- Integrating with the cloud to facilitate remote work, automated work processes, and collaboration.

- Integrating with a long list of applications from Thomson Reuters and third-party companies.

Top Add-ons For Ultratax CS Professional Tax Software

UltraTax CS Professional tax software integrates with other products in the CS Professional Suite. You can also add other apps from Thomson Reuters and third-party apps.

The CS Professional Suite applications that work with UltraTax CS are:

1. Accounting CS

Accounting CS is comprehensive accounting software. You can import the balances of your general ledger into UltraTax CS.

2. Creative Solutions Accounting (CSA)

This application enables you to process payroll tax forms, then share data with UltraTax CS.

3. FileCabinet CS

File Cabinet assists with storing documents. It automatically backs up your clients' data.

4. Fixed Assets CS

Fixed Assets CS enables you to track inventory and assets correctly for proper bookkeeping and taxes. The tool displays your client's fixed assets data in the UltraTax CS asset module. However, you must ensure that the client's ID is the same for both applications.

5. NetClient CS

NetClient CS is a private extension of your website for sharing and storing documents. It also facilitates collaboration with clients and can be accessed from any internet-connected device. You can send your clients' returns via the NetClient CS portal.

6. Planner CS

Planner CS is an application for creating strategies that will help you and your clients to prepare ahead for the next Tax Years and file better returns. You can export your clients' 1040 data into the application.

7. Practice CS

Practice CS is a workflow management application for tracking time and billing for your company. You can use it to extract invoice information from UltraTax CS and complete projects. You can also import your clients' data from UltraTax CS to Practice CS. This data includes your clients' IDs, names, contact, and SSN or EIN.

8. ToolBox CS

ToolBox CS is a tax and accounting tool that comes with tax calculators, federal forms, IRS flowcharts, and so on. By integrating it with UltraTax CS, you can import your clients' data for easy updating.

9. Workpapers CS

This is a trial balance and tax work paper application that allows you to share documents and collaborate in real-time. You can transfer your general ledger balance from Workpapers CS to UltraTax CS using the correct tax codes.

10. AdvanceFlow

AdvanceFlow is a cloud-based audit management software. You can import engagements from AdvanceFlow into UltraTax CS.

Other Thomson Reuters tools that work with UltraTax CS are:

- Onvio: a suite of cloud-based apps for tax professionals and accountants.

- GoFileRoom: a cloud-based application for storing, viewing, editing, and managing documents.

- Checkpoint: a powerful application for tax and accounting research.

- RIA Form/Line Finder: a search tool that uses line numbers and form names to locate specific form fields.

- PPC Deskbooks: it contains various categories of calculators such as tax, retirement, mortgage, credit card, and investment. With Deskbooks, you can quickly resolve tax problems and file returns accurately.

- Quickfinder: this tool was designed by tax professionals for tax research, training, updates, and quick reference. The information is useful, accurate, and concise.

The third-party apps that integrate with UltraTax CS include the following:

- SafeSend

- Universal Business Computing Company

- Fiducial Advantage

- ProSystem fx Engagement

- Client Ledger System

- Accountant's Relief

What Makes Ultratax CS a Good Tax Software?

Here's why I would rate UltaTax CS a good tax software:

- The company updates its software periodically to reflect current IRS standards

- It facilitates e-filing for both Federal and State returns

- You can use the software both on desktop and web

- It offers up to 4 different monitors, a helpful multitasking feature for CPAs and tax preparers

Who Are the Typical Users of Ultratax CS Professional Tax Software?

UltraTax CS Professional tax software is designed for large tax firms. However, it is suitable for both small and medium-sized businesses because its features allow them to multitask and increase their client base.

Pros and Cons of Ultratax CS Professional Tax Software?

Let's take a look at the advantages and drawbacks of UltraTax CS professional tax software.

Pros

- Automatic and regular updates

- User-friendly

- Intuitive dashboard

- Customized print options

- Multiple monitors for multitasking

- Integrates with multiple applications from Thomson Reuters and third-party companies

- Accurate tax returns

- A comprehensive resource center for both first-timers and returning users

- Offers both Desktop and cloud-based options

Cons

- Poor customer support via phone call

- Large returns might slow down the Desktop program

Alternatives of Ultratax CS Software

If you want to try solutions from other providers, in this section, you will find a list of tax software that you can use instead of UltraTax CS.

ProSeries Tax Software

ProSeries Tax is a product of Intuit. It offers both a Desktop version and hosting for ProSeries. The software enables e-filing, eSignature, automatic data import, and other utilities that a good tax software should possess.

ProSeries Tax improves your productivity by providing time-saving tools. Whether you're filing a large number of returns or just a few 1040s, ProSeries has a plan for you.

The plans are categorized into Basic and Professional.

Basic plans:

- Basic 20 costs $519 per year

- Basic 50 costs $799 per year

- Basic unlimited costs $1259 per year

Professional plans:

- Pay-per-return costs $369 per year

- 1040 complete costs $1999 per year

- For Choice 200 and Power Tax Library, contact the company for pricing.

Lacerte Tax Software

Lacerte is another powerful tool from Intuit that helps you to tackle complex tax returns. It offers both Desktop software and hosting, advanced diagnostics, on-screen guidance, and integration with QuickBooks, among other features.

Lacerte packages are as follows:

- Lacerte REP (pay-as-you-go plan) costs $425 per year

- For Lacerte 200 Federal 1040 and unlimited modules, call (833) 207-5516 for pricing.

CCH ProSystem fx Suite

This software contains tools for tax, accounting, workflow, and audit. It is created by Wolters Kluwer for public accounting firms. The suite facilitates tax automation, collaboration with clients, and revenue generation. Contact the company for packages and pricing.

Limitations of Ultratax CS Professional Tax Software

UltraTax CS Professional tax software has great features but it has a few limitations. First, contacting support via phone call might result in a long wait period, which is bad for business. So, if you want an immediate response, you have to scan through the Help & How-to Center to see whether the issue has been discussed there.

Secondly, the software lags, crashes, or freezes while carrying out certain tasks like opening the software, opening a client, and switching between forms and input screens. This is a simple programming issue that developers can tackle. The good thing is that the company offers suggestions for improving performance.

Is Ultratax CS Cloud-Based?

UltraTax CS is cloud-based. It offers two hosting solutions: Virtual Office CS and Software-as-a-Service for CS Professional Suite.

The Virtual Office CS, as the name implies, allows you to do all your accounting and tax tasks from the comfort of your home. It integrates with Microsoft programs and other locally installed applications. The software is hosted on Thomson Reuters's server. The company backs up your data automatically and maintains the server.

With SaaS CS Professional Suite, you only pay for the software you use. It is scalable and helps you to reduce IT costs.

Ultratax CS software vs Ultratax CS Cloud

UltraTax CS software is a tax compliance program that can be installed on a stand-alone PC or a workstation. UltraTax CS cloud, on the other hand, helps you to overcome the limitations of on-premise deployment by creating a virtual office for you. You can configure your desktop version on the cloud in order to access your data from any location.

CS Professional Suite Vs Ultratax CS Professional

CS Professional Suite is a comprehensive collection of applications and services for tax preparers and accountants. Each program works seamlessly to boost your firm's productivity and revenue.

UltraTax CS is a tax and asset management program in the CS Professional Suite. It integrates with other programs in the collection, including Onvio.

Conclusion

In a world where change is constant, no one will be happy to use an obsolete tool. Thomson Reuters places the evolving needs of customers at the heart of its software development. No wonder the company updates and upgrades its programs regularly.

UltraTax CS is one of the many products of Thomson Reuters for tax preparers and accountants. Among its features, the provision of 4 monitors stands out, helping users to stay organized while toggling between screens. You can either use the software on your desktop or with hosting.