It would be an understatement to say that managing tax operations is challenging. The complexities of the revenue laws and rules, frequent legislative and regulatory amendments, and the ever-evolving needs for data security while preparing and filing returns for multiple business and individual clients means professionals need nothing less than a brilliant tax program to get the job done. And Lacerte, the frontline tax program from Intuit makes for an impeccable digital solution in this context. Made by the CPAs for the CPAs, Lacerte has been helping accounting firms and tax practitioners for several years in automating tax workflows and filing even the most complex returns with ease.

What is Lacerte Tax Software?

Lacerte is a powerful, feature-loaded software that offers end-to-end tax preparation and return filing solutions for both individuals and businesses. Coming from the vault of the American accounting and tax software giant, Intuit, Lacerte is a good fit for tax and accounting firms, CPAs, small and mid-sized businesses and individual tax practitioners as it features a comprehensive set of in-built tools, utilities and functions along with more than 5,700 tax forms to handle a wide variety of return types - federal, state, and local income tax returns along with property tax returns.

It comes loaded with advanced e-filing capabilities to make the process of tax preparation and filing simpler and quicker by cutting down manual paper-based tasks. The frontline tax program offers multiple filing options, allowing users to electronically submit multiple returns simultaneously from one central client file along with providing the option for year-round e-filing, enabling users to e-file current and previous year returns. Lacerte offers full integration with QuickBooks Accountant as well as improved eSignature feature. All these attributes collectively make Lacerte a complete 360° tax program.

Before diving deeper into the topic, here’s a quick video by (Name & Designation) highlighting why Lacerte is one of the most predominant tax applications in the US.

Want to Move your Lacerte Tax Software to the Cloud?

Start 7 Day Free TrialWhat are the features of Lacerte tax software?

With an user-friendly interface, Lacerte is easy to navigate and provides quick access to the forms, files and associated data required for seamless tax preparation. The enhanced e-file wizard simplifies the process of filing multiple forms simultaneously, and the unique eSignature feature delivers more prominent and more accurate signature capture capability than the previous editions.

Here are some of the most innovative features of the tax software:

User-Friendly Interface

User-Friendly Interface

Speed up your tax filing process with distinctive time-saving features like:

- View clients at one tab with customizable columns.

- Easy to enter data with flat Worksheet-based design.

- Speed up the review process using the tab design.

- Seamless navigation to forms, repair, diagnostic and print function with a single click.

- Strategically placed tabs to match tax return common flow, so it's easy to learn and use.

Reliable & Fast Multi-User Performance

Reliable & Fast Multi-User Performance

Collaborate with your team members and work in sync on the same tax software and never put a halt on your work speed!

- Rock-solid networking capabilities allow the tax software function at its maximum potential, whether you use it on a single desktop or multi-user mode.

- Maintain uniform processing across the entire firm by setting preferences including invoice schedule.

- Reduce unnecessary time-consuming work and billing issues. For firms that use varied preparer license files, download and assign exact prep match files automatically.

QuickBooks Accountant Integration

QuickBooks Accountant Integration

With the Intuit Lacerte application, quickly integrate the QuickBooks Accountant program so you can import data entry balance into your dashboard.

- Assign tax fields automatically to your trial balance accounts.

- Make corrections in the data before posting it on the trial balance.

- Build a custom database by automatically saving updated assignments. Complete one client returns and automatically the other returns too quickly.

Comprehensive Form Library

Comprehensive Form Library

Lacerte tax application comes with more than 5,700 forms to address all types of return filing requirements for both . Further, it supports K-1s, multi-state, consolidated corporations, oil and gas industries, and a plethora of other modules. Some of the available tax forms include:

- 1040

- 1041

- 1065

- 1120 & 1120S

- 706

- 709

- 990

- 5500

Lacerte can import data from CSV or Excel files directly into the Schedule D form, reducing the manual data entry process. Further, 1099 and W-2 data can be downloaded directly from its financial institution into the tax software.

Advantage of E-Organizer

Advantage of E-Organizer

E-organizer is a paperless way of collecting data necessary for preparing the return. It enables sending surveys, forms, and e-mails to clients to gather essential data within the tax software.

In addition, clients get access to a customized, password-secured executable file, which has the full report on know-how to use the organizer, FAQs, and many more.

Missing Client Data Utility

Missing Client Data Utility

Never miss a field with this tool. Identify the columns unfilled and immediately ask for the needed data by sending emails to the client. Just flag input fields in the detail window while evaluating a return, and when you get data from your client, go straight to the input fields to close the return. Hence, you streamline your entire data entry process with missing client data utility.

Trial Balance Utility

Trial Balance Utility

This tool is really helpful for tax and accounting firms, accountants and tax preparers to finish their year-end client trial balance statements. With this, create charts, modify journal entries, review trial balance statements, and much more. Plus, seamlessly import financial data from QuickBooks to your excel sheet for accurate data entry.

Tax Analysis & Planning tools

Tax Analysis & Planning tools

Tax analysis and planning tools are especially curated tools to help professionals in analyzing and strategizing taxes for a wide assortment of clients.

- It is sold as part of a bundle and provides integrated client service tools to provide services beyond just the basics of a tax return.

- Lacerte Tax Planner can quickly plan out customized strategies to lessen clients' future tax liability.

- Lacerte Tax Analyzer is a valuable tool that advises your clients regarding the implications of the new law. Not just this, it will red flag any amounts in your return filing that is likely to trigger an IRS audit. So you avail professional tax services with this solution.

What's New and What’s Updated in Lacerte Tax 2021?

One of the major reasons why Lacerte remains at the forefront of tax operations is the fact that Intuit releases new versions of the program every year adding more enhancements, tax forms and packages, and bringing more handy features while also complying with the latest laws and rules to help tax practitioners tackle even the most complex returns.

With reference to what’s new for the software this year, there’s a whole lot of improvements and enhancements to streamline day-to-day activities and provide smoother tax preparation and filing.

Following are the major and minor updates to boost performance and simplify taxation process:

New Updates

- Verify your Electronic Filing Identification Numbers (EFIN) in the tax program

- Notifications and alerts regarding tax accuracy

- Updated profile for billing

- Simplified cloud integration for remote access

- Lacerte 200 Federal 1040 enhancements

- Lacerte Actionable Steps for Error Resolution (LASER)

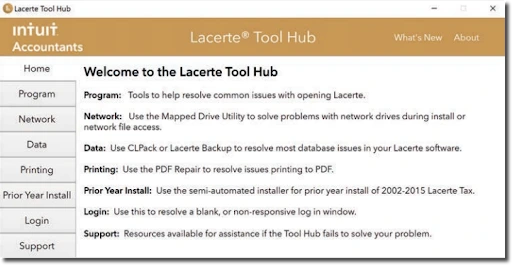

Lacerte Tool Hub

Another section where Lacerte has seen major improvements is the Tool Hub section, which is now more detailed and more equipped to help users quickly resolve common system errors and bugs empowering you to do what you do the best, serving your clients. You can use “Tool Hub” to fix different issues, including but not limited to:

- Repair Updates

- Desktop alerts

- Mapped Drive Tool

- Networking Issues

- Component Repair Tool

Simplified Access to Lacerte Support with 1-on-1 assistance and multiple self-help tips:

Get product support at your convenience: It now allows you to book appointments or request a callback from the support team for troubleshooting.

Voice Assistant: Lacerte now comes with an in-built voice assistance feature to help you get the required resolutions by directing you to self-serve instructions provided by Lacerte Support.

The Lacerte Tax Idea Exchange: This is a unique initiative by the Support Team to collect important pointers and feedback from the users which help in their endeavor of further research and development and bring in newer and better solutions.

For complete details regarding the newest updates and features, click here.

What are the Benefits of Lacerte Tax Software?

E-filing

E-filing

As discussed above, e-filing is the single-most unique feature of Lacerte Tax Software, which helps professional CPAs and accounting firms provide quicker and efficient tax processing and filing for a large number of clients.

- Harness the power of inbuilt e-filing capabilities designed to cover both business and individual taxpayer requirements.

- E-file wizard, a handy utility that makes return filing easier and quicker when transmitting return, particularly while troubleshooting validation errors.

- Easily authenticate data transmission via your local desktop-based software.

- Keep yourself updated with the IRS e-file mandate

- Innovative batch filing option to assist tax professionals handle e-file extensions for multiple clients, everything in one-go.

Expanded e-filing

Expanded e-filing

Lacerte tax software has been designed to cover frequently changing dynamics of tax operations by delivering comprehensive solutions and this is why Intuit keeps pushing for new updates and incorporating new tax forms and making the application flexible enough to meet the electronic return filing needs of the taxpayers in different states.

Visit Lacerte support for complete details regarding new form addition and by when they will be available for e-filing.

E-organizer

E-organizer

Get access to the essential accounting and financial data from each of the clients in just a few clicks and store them in one place faster operations. Instead of paper organizers, make use of the.customized software for tax analysis and strategic planning.

- Easy-to-use and share electronic forms, checklists, questionnaires and other documents for easy understanding and communication between staff and the clients.

- Get rid of the manual tasks like printing, assembling, and mailing paper organizers, which saves both time and money.

- Files are protected by passwords, which grants complete security to confidential business information.

- Easily transfer approved numbers onto the respective tax forms online and minimise the chances of data-entry errors.

Each of the packages contains unique download links to access and download password-protected, executable documents on the local systems of every individual client. The tool includes everything they require - introduction, user guide to add-on usage, FAQs, a section to raise queries and concerns and a feature to download tax files into the program itself.

Combined E-file Wizard

Combined E-file Wizard

Make full use of the single e-file wizard available to handle standard as well as other filing types, like Property Tax, Corporate Tax and Limited Liability Company (LLC) Tax. The same e-file wizard can be used to deselect/select filings for federal, state and other filings, helping to reduce the time and hassle of having to file with two separate tools.

Multiple Filings per Client

Multiple Filings per Client

Boost the overall efficiency and productivity of your accounting and tax firm. Lacerte tax software allows you to add different instances related to the return filing of the same user, thereby saving your valuable time and efforts.

E-filing for Multiple Clients

E-filing for Multiple Clients

Filing instances were already supported in a single client e-file. Also, CPAs, accounting and tax practitioners can now e-file for multiple clients simultaneously without disrupting the workflow or the process.

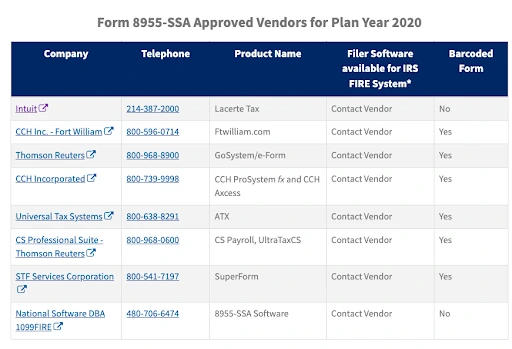

Is Lacerte Certified by the Internal Revenue Services?

Yes, Lacerte has received filing acknowledgment by the IRS, which has further validated the usage of the tax program. Tax software programs used for preparing and filing returns electronically are required to pass the requirements for Modernized e-File Assurance Testing (ATS) to ensure that the applications can provide accurate data in predefined formats for further processing. Lacerte Tax Program and Lacerte is one of the most popular programs to consistently pass the ATS.

For Plan Year 2020, Lacerte topped the list of Form 8955-SSA Approved Vendors. Considering the fact that the tax software provides more than 25,000 diagnostic utilities divided into three categories, all contribute to minimize the chances of rejections from the IRS. Within the software itself, you can analyse and compare every return to the IRS database averages for similar returns filed. This feature helps you stay updated about the potential missed information or the possible issues that could trigger the IRS Red Flag.

Lacerte - Recognized by AICPA Members (Not a new section but continuation to the Previous Section)

Owing to the efficient in-app tools, features and comprehensive tax packages, it has evolved as one of the most popular and used tax applications in the United States. In fact, Lacerte has received the highest level of accolades, one of them being earning top recognition from Association of International Certified Professional Accountants (AICPA). As per the 19th Annual Tax Software Survey of AICPA Members by the JofA and The Tax Adviser regarding the most predominant tax products, Lacerte garnered 16% of the total votes; second only to Thomson Reuters’ UltraTax CS Software, which was chosen by 20.7% of the members.

Limitations of Lacerte Tax Software

While the software has been efficiently designed to serve a wide range of tools and features to provide hassle-free tax preparation and filing, there are a few limitations of Lacerte that you need to be aware of, especially when you are planning to implement it in your practice.

The application doesn't support:

- Like-kind Exchanges.

- Form 2106.

- Schedule E (Vacation/Holiday Homes).

In addition, the software doesn't have any features related to:

- Printing estimate vouchers.

- Importing most overrides or adjustments from other software solutions (only Schedule D overrides are imported).

- Handling sheets related to local and state tax refunds for the clients.

- Managing long-term care premiums

- Exporting estimated payment dates regarding additional estimated payments in the 4th Quarter (The entire NOLs (net operating loss) are exported into a single code).

- It doesn't have any auto-save feature to automatically save made changes.

Don't let the application's limitations restrict your productivity.

Book your free demo right now and see how cloud can add value to your operations.

How is Lacerte Software different from Other Tax Solutions?

When it comes to top-of-the-line tax software solutions, there are a few handy options available. Each of the software packs a wide range of features, tools and functionalities along with having dedicated Tax modules and packages designed to serve individual and corporate taxation requirements.

Given below is a comparison table, which highlights how Lacerte racks up against the likes of ProSeries, UltraTax CS and Drake Tax Software.

| ProSeries | Lacerte | UltraTax CS | Drake Tax | |

|---|---|---|---|---|

| Developed by | Intuit | Intuit | Thomson Reuters | Drake Software |

| Entry Level Pricing | $340 per year | $400 per year | $2500 per year | $330.00 |

| Free Trial | Yes | Yes | Yes | NA |

| Client-base | Tax accountants | Tax professionals and tax accountants | Tax professionals | Tax professionals |

| Platform Supported | Windows SaaS | Windows SaaS | Windows SaaS | Windows SaaS |

| Training Documentation | Yes | Yes | Yes | NA |

| Tech Support | Yes | Yes | Yes | NA |

| Tax Planning | Yes | Yes | Yes | Yes |

| Corporate Tax | Yes | Yes | Yes | Yes |

| Sales Tax | Yes | Yes | Yes | Yes |

| Add-ons Integration | Yes | Yes | Yes | Yes |

- When you prepare tax with Intuit Lacerte tax preparation software, you achieve a far more efficient and effective process and are solely responsible for engaging in core activities. The entire tax filing gets automated by the powerful functions the tax software encompasses.

- Also, the seamless integration with QuickBooks accounting software lets you save time and effort and synchronize the tax plus accounting data.

- Further, when it comes to filing complicated tax filings, it is viewed as the best-valued solution. It has more than 5,700 forms, including modules 1065, 1120, etc., and offers a unique interface and automated calculations, so you rely heavily on the application for the tax filing process.

What is Lacerte Document Management System?

Lacerte Document Management System (DMS) is a desktop-based program primarily designed as an add-on, which when integrated with the tax software can enhance the potential and add more value to the application. Lacerte DMS makes use of a database, configured for storage either on the local desktop or as a shared database over a network server to store mission-critical documents and files. In both configuration models, the program is set up on each computer and doesn't require any special software or hardware upgrades.

While there are a number of Lacerte DMS solutions available, there are two tools, namely SmartVault and Document Management System offered by Intuit to help CPAs, Tax accountants and Tax Practitioners go paperless and boost efficiency in terms of tax preparation workflow. Both the tools are compatible with Lacerte Tax Software and can be integrated with ease. These innovative add-ons give you the freedom to easily and quickly capture, manage, store, and share almost every detail of the clients.

Listed below are some of the major features of SmartVault and Document Management System:

SmartVault

SmartVault

This add-on gives you the ability to store documents on cloud-based servers so that you can easily access the required documents from anywhere at any time.

- Access files from any desktop, laptop, or any smart device.

- Customize your dashboard for easy file sharing with clients.

- Customize folders, documents and email templates for easy onboarding and management of clients.

Document Management System

Document Management System

This add-on comes with some really handy features to help users to access, scan and store returns and source documents and files of the clients. It gives you the ability to:

- Scan and store files on your local PC.

- Access, view, edit, modify, fax, or share information on email from your own device from anywhere.

Top Add-ons of the Lacerte Tax Software

Lacerte users can leverage their productivity by including integrated add-on applications to finish their online tax workflow effectively.

eSignature Plus Payments

eSignature Plus Payments

In collaboration with DocuSign, Intuit introduced eSignature Plus Payments feature in the last edition. The Federal Revenue Agency, the IRS has validated the integration of eSignature with the tax application to help secure digital signatures for confidential documents, engagement letters, W-9s, Forms 8879, Forms 4506-T, and 7216 Consent Forms. Also, it offers a unique option for payment collections, which enables you to raise requests and collect payments. It doesn't not only fastrack your billing process but also saves you valuable time.

Further, it also comprises eight statuses to ease the proceedings for both individual and business taxpayers. They are:

- Declined

- Failed Authentication

- Delivered

- Multiple

- Partially signed

- Signed

- Voided

- Expired

Hosting for Lacerte

Hosting for Lacerte

Move your desktop solution to the cloud with enterprise-grade security to securely access and execute your tax operations on the go. Get rid of in-house IT infrastructure setup and maintenance; free data migration and free support round-the-clock to accelerate your cloud journey. Get any time, anywhere access with any device, plus work simultaneously on the same data files with multi-user mode.

Pay-by-Refund

Pay-by-Refund

Shed the burden of paying and collecting tax preparation fees from your client's shoulders. Avail of the benefit of Intuit's refund transfer scheme, including identity theft protection. Also, sign up via your preferred professional tax solution and invite your clients. It's just that easy!

Intuit Link

Intuit Link

Manage and organize client data with the Intuit Link online portal. You can enjoy this add-on at no extra cost. Your clients will profit from new login enhancements, so they can seamlessly access their accounts. With this, they easily and securely send you their tax documents.

Intuit Practice Management

Intuit Practice Management

Get more clarity and check over your firm workings, while lessening time spent on repetitive tasks. Therefore, you can keep a tab on your clients. Intuit Practice Management automates and standardizes your firm's actions and maintains the data refreshed and in sync over every other Intuit accounting and tax software platform.

What Values do Lacerte Tax Software Add?

Following are some of the most significant advantages of using the Lacerte software:

Time Saving

Time Saving

Traditional tax filing can consume your time and efforts. Lacerte e-filing option allows smooth transmitting of returns. The application ensures you stay updated with the latest IRS e-file mandate for the relevant tax season.

Easy QB Integration

Easy QB Integration

With QuickBooks seamless integration, your tax and accounting process can go hand-in-hand. So you don't have to worry about reconciling your tax statements and accounting, Lacerte solves this for you!

Pre-loaded Forms

Pre-loaded Forms

It has more than 5,700 forms enabling you to provide tax processing and preparation services to multiple clients with different needs. Directly import your tax data from CSV files to schedule D.

Ease of Use

Ease of Use

Lacerte eliminates the need to track clients' data. Just identify and complete the missing information by sending a request to the client to give the necessary details to complete the return.

Advanced Diagnostics

Advanced Diagnostics

Lacerte can run 2,500 advanced diagnostics to identify errors and mistakes and provide you with a detailed report.

Lacerte Software Plans

Lacerte provides plans customized according to different tax professionals and client needs and specific requirements. Generally, it has three packages to offer:

Lacerte 200 Federal 1040:

It comprises a distinctive collection of different forms designed for federal return filing for up to 200 individuals.

Lacerte Unlimited Modules:

It has the same modules and features as Lacerte 200 Federal 1040 but it is available for filing unlimited individual and business returns.

Lacerte REP:

For limited filing of individual, state and business returns, opt for Lacerte REP backed by pay-as-you-go pricing model.

| Features, Tools & Utilities | Lacerte 200 Federal 1040 | Lacerte Unlimited Modules | Lacerte REP |

|---|---|---|---|

| Number of Federal 1040s | More than 200 | Unlimited | Pay-per-use |

| Number of Business Return Filing | Pay-per-use | Unlimited | Pay-per-use |

| Consolidated corp (1060, 1120), Estate (706), Benefit (5500), 1041, 1065, 1120S, Exempt (990), Gift (709) | Pay-per-use | Compatible | Pay-per-use |

| Cloud Access | Supported | Supported | Available as an Add-On |

| E-Organizer | In-Built | In-Built | - |

| Intuit Link | Yes | Yes | Yes |

| K-1 Import | Yes | Yes | Yes |

| Trial Balance Utility | Yes | Yes | Yes |

| Missing Data Utility | Yes | Yes | Yes |

| Tax Planner & Analyzer | Additional Cost of $277 | Included | Additional Cost of $277 |

| Multi-user Mode | Yes | Yes | Yes |

| Multi-State Support | Yes | Yes | Yes |

| Data Conversion Services | Yes | Yes | Yes |

| QuickBooks Accountant Integration | Yes | Yes | Yes |

| Option for Refund Transfer | Yes | Yes | Yes |

| Supported Add-ons |

|---|

| Quick Employer Forms | $171 | $171 | $171 |

| SmartVault Document Management integration | Pricing varies | Pricing varies | Pricing varies |

| Remote Hosting | Pricing varies | Pricing varies | Pricing varies |

| Practice Management | Pricing varies | Pricing varies | Pricing varies |

| Option to use eSign for Form 8879 and Others | Single: $2.99 Batch of 50: $124.50 Unlimited: $1,784 | Single: $2.99 Batch of 50: $124.50 Unlimited: $1,784 | Single: $2.99 Batch of 50: $124.50 Unlimited: $1,784 |

| Tax Scan & Import | Single: $12 Unlimited: $1910 | Single: $12 Unlimited: $1910 | Single: $12 Unlimited: $1910 |

Get essential information about Lacerte Tax Software Hosting

Check Pricing & Plans

Check Pricing & PlansWho can Use Lacerte Tax Software?

- The ideal user base of Lacerte

As explained above, Lacerte Tax Software carries possibly everything from state and federal tax forms and packages to innovative tools and utilities required by tax practitioners for hassle-free return filing. It lets them focus on their core areas of competency while helping professionals with their specific tax preparation requirements. For tax preparation assistance, including tax processing and e-filing, it is best suited for:

- Corporates

- Individuals

- Small to Medium-sized tax practices

- Tax consultants

What Kind of Support Do You Get with Lacerte Tax Software?

Lacerte offers comprehensive support to troubleshoot software-related bugs keep your application and your operations running smoothly. You can contact Lacerte Support Team via

- Phone: +1-800-933-9999 (Toll-Free)

- Live Chat

Support Hours

| Regular hours of operation | Open | Close |

|---|---|---|

| Mon-Fri | 6:00 AM | 5:00 PM |

| Sat | Closed | Closed |

| Sun | Closed | Closed |

During the tax season, extended support is provided even on the weekends. To know more about the latest info regarding support hours, click here.

Online User Guide

- In-program Help

- Help Me Feature with Screen-Specific Points

- IRS Instructions on Every Form

Is Lacerte Software Cloud-Based?

As explained above, Lacerte software is a comprehensive tax application packing some really powerful and handy functions to help you streamline tax data collection and filing process with utmost accuracy. However, Lacerte is conventionally a desktop-based application and like all other desktop apps, it has fixed accessibility, scalability, data sharing, and workflow limitations.

Luckily though, Lacerte hosting on the cloud has evolved as one highly efficient and cost saving alternative to traditional software deployment technique and for good reasons. It enables you to access and use the same desktop software with the same interface, features and tools with added benefits of the cloud like remote accessibility, scalability, reliability and data security.

Hosting Lacerte on cloud means deploying the licensed copies of the application on remote servers. The cloud platform is fully managed by third-party service providers. It helps cut down your operational budget significantly given that it eradicates the need of having an in-house IT infrastructure and a dedicated team to manage it. High performance virtual servers pack adequate computing and storage resources, and depending on your specific operational requirements, you can get your cloud platform customized. With pay-per-use subscription models, you only need to pay for the resources that you consume, without paying for additional bells and whistles.

Following are some of the most important reasons why you should give cloud a serious consideration if you are a Lacerte user or are planning to deploy the software in your firm.

100% Remote Accessibility

100% Remote Accessibility

Hosting Lacerte on remote servers empowers accounting and tax firms to access the software from anywhere through any web-connected device. It means you and your team no longer have to be bound to the office PC to accomplish the tasks. It removes all kinds of devices and geographical barriers, giving busy professionals like you a competitive edge by helping you stay connected to your team and your business, no matter where you are in the world.

Customizable and Scalable

Customizable and Scalable

Cloud Hosting offers multiple options for resource customization, and as a user, you have all the freedom to choose the best suited computing resources, like RAM, disk storage, and processors. The best part is the cloud-based solutions are generally based on pay-per-use models, meaning you only need to pay for the absolute resources. As per the changing business requirements, you can scale up or down your cloud resources and still work with your full potential. By moving your tax software to the cloud, you don't have to spend on on-premise network setup or maintenance.

Enterprise-Grade Security

Enterprise-Grade Security

Reliable Tax Application Hosting providers are mostly SSAE-18 certified with HIPAA compliant and follow the latest security guidelines along with deploying some of the most prominent physical, electronic and digital security measures to protect sensitive business information from the prying eyes of the cybercriminals.

Some of the include:

- Data Encryption

- Two-Factor Authentication

- Anti-virus Programs

- Anti-Malware Systems

- Network Firewalls

- 24x7 Monitoring

- Intrusion Detection and Prevention Programs

Besides, your business-critical information is backed up on multiple levels at different data centers so as to ensure that your data can be recovered and restored in case of any accidental deletion, loss or damage.

Free Technical Support

Free Technical Support

Why spend unnecessary time on IT matters? Cloud-based solutions let you focus on your core activities. So, even if you are confronted with any glitch or bug related to the application, dedicated cloud technicians are available round-the-clock to identify and troubleshoot all kinds of errors and bugs and leave no stones unturned to keep your system up and running. Cloud hosting providers also ensure timely system updates and upgrades so that you are free from all kinds of IT-related hassles, which means you can spend your valuable time doing what you do the best - serving clients.

Integration with Third-Party Applications

Integration with Third-Party Applications

Although you can download and install third-party programs on your local PC, it can impact the system speed in some or the other way. So, when you choose to migrate Lacerate software to the cloud- it gives access to virtually unlimited storage and won't hamper your PC speed.

Lacerte cloud hosting platform supports smooth integration with third-party add-ons. Since everything is stored in the cloud servers, from your core application and your associated files to third-party tools and add-ons, you can perform your day-to-day operations with maximum efficiency.

Talk to cloud experts regarding customized hosting solutions

Start a Free Conversation

Start a Free ConversationBottom Line!

Lacerte is a complete software solution bringing to you more than 5,700 states and federal tax forms along with the essential features and tools for smooth tax preparation and filing process. It offers very accurate and updated calculations with easy-to-understand promptings to redirect you to potential forms required for return filing. In addition to automated calculations, utilities like trial balance utility, e-organizer, automatic backups and many other useful functions help you glide through the process of tax preparation and filing needs of all your clients.

What makes Lacerte a complete tax application is - it is compatible with QuickBooks, Intuit’s very own desktop accounting software, QuickBooks along with many other third-party apps and add-ons, which when integrated go a long way in enhancing overall functionality, usability and performance of the application, thereby helping CPAs and professional tax professionals in handling a wide assortment of clients simultaneously and stay on track even during the busiest of seasons. And the innumerable diagnostic utilities offered by the software helps minimize the chances of IRS rejections and expect quicker refunds.

Frequently Asked Questions

Why is Lacerte cloud hosting a suitable choice for tax practitioners?

It’s only because it gives Lacerte cloud hosting gives tax professionals multiple benefits like: anywhere and anytime access, high performance computing with no major investment in IT infrastructure, enterprise-grade security of Tax preparation data, etc. Nowadays, when excellent team work is hailed as the only way of productive working culture, Lacerte cloud hosting.

Hosting cost of Lacerte tax software depends upon various factors like: number of users to have concurrent access, number of applications you need to install on the same hosted platform, storage space you need, etc. Since cloud oriented resources are scalable in nature, you can further customize as per your exact requirements, reflecting directly into your cost. Pay as you go.

What are the benefits of Lacerte software hosting?

Team collaboration, high performance compute power, cutting edge security, and round the clock support are the major benefits of cloud hosting of Lacerte tax application.

Can you drag attachments directly into the eFileCabinet?

Which tax software features do practitioners consider the most important? Can you print directly from Lacerte, qb, microsoft office and email to eFileCabinet? What problems are you solving with the product?

Does this include a web portal?

Since Lacerte tax software consists of a vast list of features, tools and utilities to perform tax preparation easily and conveniently. Thus it’s a little heavier application to be accessed via a web portal. However, you can use the cloud hosting of Lacerte application to have internet based access.

How lacerate hosting is time saving?

Lacerte hosting is time saving by many means like: you don’t need to spend your time planning of applications’ availability, data backup, security since hosting providers are largely responsible for these arrangements. You can just focus on your core jobs to serve your clients better.

Does Lacerte software perform better on the cloud?

Absolutely. There are multiple reasons to assert that cloud based Lacerte tax software performs better on the cloud and major reasons are: accessibility of Lacerte tax application all the time, real-time information synchronization amongst multiple applications, a highly secure way of data transmission during tax submission, etc.

What kind of technical support do you get?

Intuit has a number of s like: technical support depending upon your agreement with them, forums to communicate with the experts, and a long list of knowledgebase articles to assist you if there’s any issues. However, if you further want to extend your technical support, hosting providers for Lacerte tax software are available 24X7 to help whenever there’s any need.